Investors reacted positively to the strong US private sector employment report from the ADP released on Wednesday. According to this report, the number of new jobs in the private sector increased in September (from 340 thousand to 568 thousand). This is much better than the forecast of economists +428 thousand new jobs.

After the publication of the ADP report, American stocks indices turned to growth after declining the day before, and the investors "appetite" for risk increased after it became clear that the Democratic Party representatives in the Senate are inclined to accept the Republican proposal to postpone the discussion of the national debt ceiling at the end of this year.

The DXY dollar index also ended yesterday's trading day in positive territory, strengthening for the second day in a row, although it declined from yesterday's intraday high 94.45. As of this writing, DXY futures are traded near 94.20, just 7 pips below yesterday's close.

However, despite this decline, the positive dynamics of the dollar index remains. Market participants expect that strong macroeconomic statistics will become an additional argument for the Fed when deciding whether to start curtailing stimulating programs this year.

Investors are now awaiting the release on Friday (12:30 GMT) of the September US labor market report, which is expected to come out strong. Economists' optimistic forecasts suggest a twofold increase in the number of new jobs created outside the agricultural sector (+435 thousand after an increase of +235 thousand in August), as well as a further decrease in unemployment in September to the level of 5.1%.

If the data is confirmed or will be close to the forecasted values, then the dollar is likely to receive an additional incentive to further strengthen.

Also at the same time (at 12:30 GMT) on Friday, Statistics Canada will publish data on the country's labor market for September. Unemployment has risen in Canada in recent months, including amid massive business closures due to coronavirus and layoffs. Unemployment rose from the usual 5.6% - 5.7% to 7.8% in March and already up to 13.7% in May 2020. If unemployment continues to rise, the Canadian dollar will decline. If the data turn out to be better than the previous value, the Canadian dollar will strengthen. A decrease in the unemployment rate is a positive factor for CAD, an increase in unemployment is a negative factor. In August, unemployment was at the level of 7.1% (against 7.5% in July, 7.8% in June, 8.2% in May, 8.1% in April). According to the forecast, it is expected that unemployment in Canada fell to 6.9% in September, and the number of employed increased by another 60 thousand. This is positive data for CAD, whose quotes are likely to rise after the publication of these data.

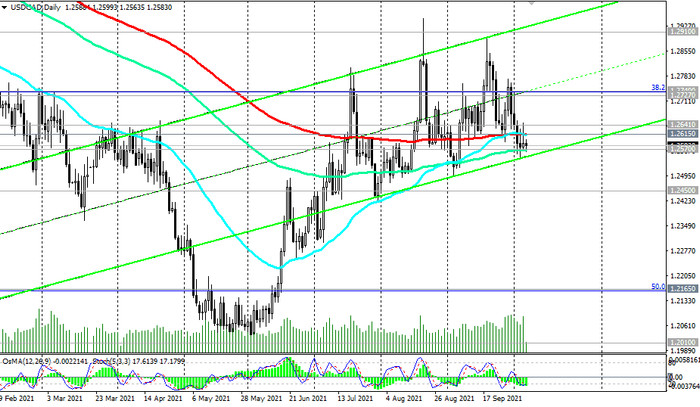

Otherwise, the Canadian dollar will decline, including in the USD / CAD pair, which at the time of publication of this article is traded near the 1.2582 mark, remaining in the bear market zone below the key resistance levels 1.2910, 1.2615 (see “Technical analysis and trading recommendations”).

At the same time, the Canadian dollar is receiving strong support from oil prices, which save positive dynamics and renewed yesterday almost 3-year highs near $ 79.00 for WTI and $ 83.00 per barrel for Brent. Canada is the largest exporter of oil, and the share of oil and petroleum products in Canada's exports is approximately 22%.

Despite some uncertainty in the oil market due to the spread of the delta strain of the coronavirus, many leading economists predict a further increase in energy prices (coal, gas, oil), including due to expectations of a cold winter and rush demand in the gas market.

Thus, on Friday at 12:30 (GMT), a sharp increase in volatility is expected in the financial markets and, above all, in the USD / CAD pair. If the official data of the US Department of Labor turns out to be disappointing, then we should expect a further decline in USD/CAD.

From the news for today, it is worth paying attention to the publication (at 12:30 GMT) of weekly data from the US labor market with statistics on the number of jobless claims (it is expected that the number of initial claims for unemployment benefits in the US in the week before October 01 fell to 350 thousand from 362 thousand a week earlier, which is a positive factor for the dollar) and the publication at 14:00 PMI from Ivey, which is an important indicator of the Canadian economy. And at 16:00, the head of the Bank of Canada Tiff Macklem is scheduled to speak. If he touches on the topic of the monetary policy of the Bank of Canada, then the volatility in the quotes of the Canadian dollar will rise sharply. His tough tone will help strengthen the Canadian dollar in the short term. The soft rhetoric of Tiff Macklem's speech and the propensity to pursue a soft monetary policy will negatively affect the CAD quotes.