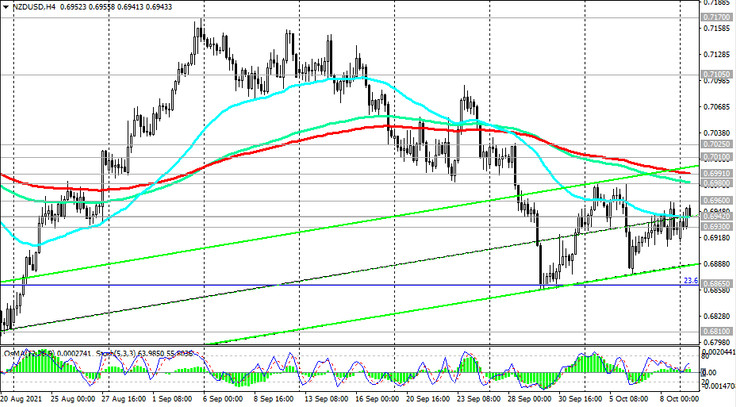

As we noted above, at the time of publication of this article, the NZD / USD pair is near the 0.6942 mark, through which an important short-term support level (EMA200 on the 1-hour chart, EMA50 and the middle of the ascending channel on the 4-hour chart) passes. At the same time, a breakdown of one of the levels 0.6960 or 0.6930 may determine the direction of further short-term dynamics of NZD / USD.

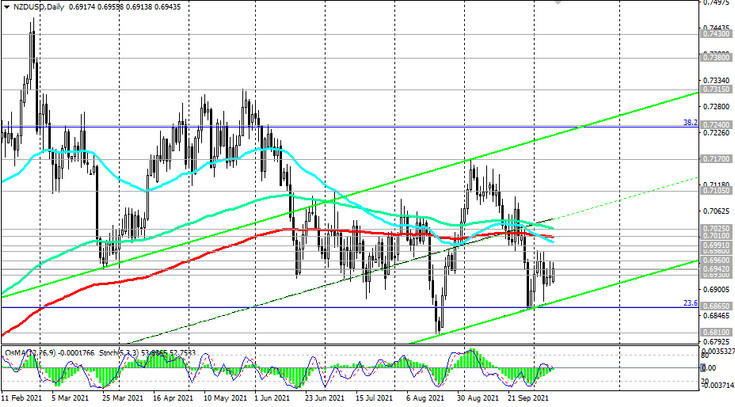

If the decline resumes, after the breakdown of the 0.6930 support level, NZD / USD will go towards the lower boundary of the ascending channel on the daily chart and support levels 0.6865 (ЕМА200 on the weekly chart and 23.6% Fibonacci retracement level in the global wave of the pair's decline from 0.8820), 0.6810 (local multi-month lows).

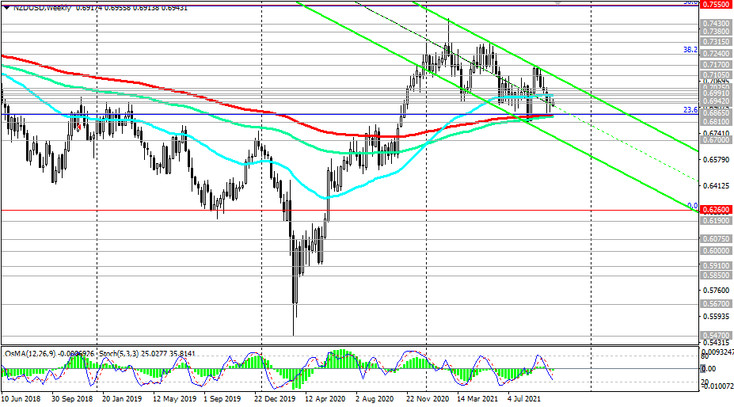

A breakout of the 0.6700 support level (the lower line of the descending channel on the weekly chart) could finally push NZD / USD into the bear market zone and return it to the global downtrend that began in July 2014.

In an alternative scenario and after the breakdown of the resistance level 0.6960, NZD / USD may rise to the key long-term resistance level 0.7010 (ЕМА200 on the daily chart). Break of another strong resistance level 0.7025 (ЕМА144 on the daily chart) will confirm the resumption of long-term bullish dynamics in NZD / USD. More distant growth targets are located at resistance levels 0.7430, 0.7550 (50% Fibonacci level), 0.7600.

Support levels: 0.6942, 0.6930, 0.6865, 0.6810, 0.6750, 0.6700

Resistance levels: 0.6960, 0.6980, 0.6991, 0.7010, 0.7025, 0.7105, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

Trading recommendations

Sell Stop 0.6920. Stop-Loss 0.6965. Take-Profit 0.6900, 0.6865, 0.6810, 0.6750, 0.6700

Buy Stop 0.6965. Stop-Loss 0.6920. Take-Profit 0.6980, 0.6991, 0.7010, 0.7025, 0.7105, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600