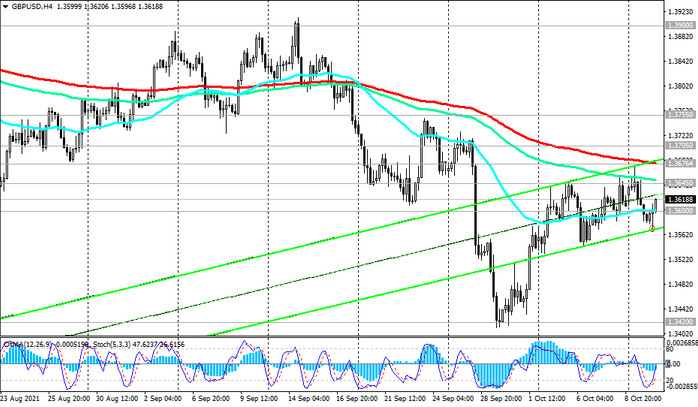

As we noted above, for the 7th day in a row, the GBP / USD pair is traded near the 1.3600 mark, through which the short-term balance line, expressed as a 200-period moving average on the 1-hour chart, passes. A confirmed breakout of this level in one direction or another will determine the direction of the dynamics of the GBP / USD pair in the medium term.

In case of GBP / USD growth, the nearest targets will be the resistance levels 1.3676 (ЕМА200 on the 4-hour chart), 1.3705 (ЕМА200, ЕМА50 on the daily chart).

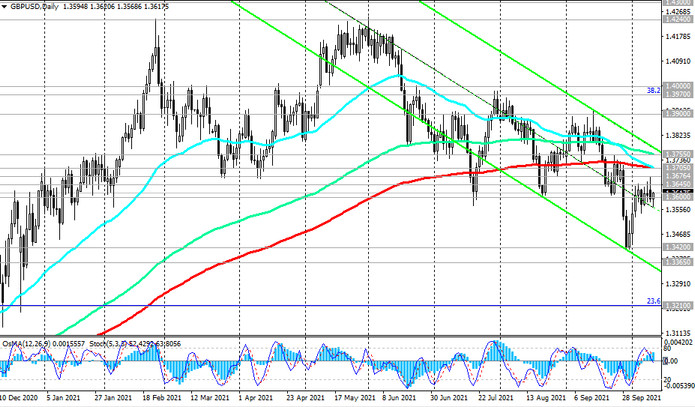

Breakdown of the resistance level 1.3755 (ЕМА144 and the upper line of the descending channel on the daily chart) will strengthen the upside potential and the positive dynamics of the pair, directing it towards the resistance levels 1.3900, 1.3970 (Fibonacci 38.2% level of the correction to the decline of the GBP / USD pair in the wave that began in July 2014 near the level 1.7200), 1.4000.

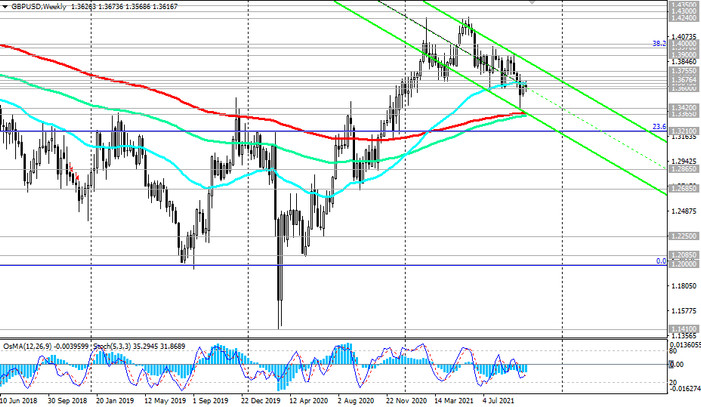

In an alternative scenario, GBP / USD will resume its decline. The first signal for the resumption of sales will be the breakdown of the support level 1.3600, and the target of the decline is the key support level 1.3365 (ЕМА200 and the lower border of the descending channel on the weekly chart).

A breakout of the 1.3210 support level (23.6% Fibonacci level) will finally bring GBP / USD back to a long-term bear market.

Support levels: 1.3600, 1.3500, 1.3420, 1.3365, 1.3210

Resistance levels: 1.3645, 1.3676, 1.3705, 1.3755, 1.3900, 1.3970, 1.4000

Trading recommendations

GBP / USD: Sell Stop 1.3560. Stop-Loss 1.3655. Take-Profit 1.3500, 1.3420, 1.3365, 1.3210

Buy Stop 1.3655. Stop-Loss 1.3560. Take-Profit 1.3676, 1.3705, 1.3755, 1.3900, 1.3970, 1.4000, 1.4100, 1.4200, 1.4240, 1.4300, 1.4350, 1.4440, 1.4580, 1.4830