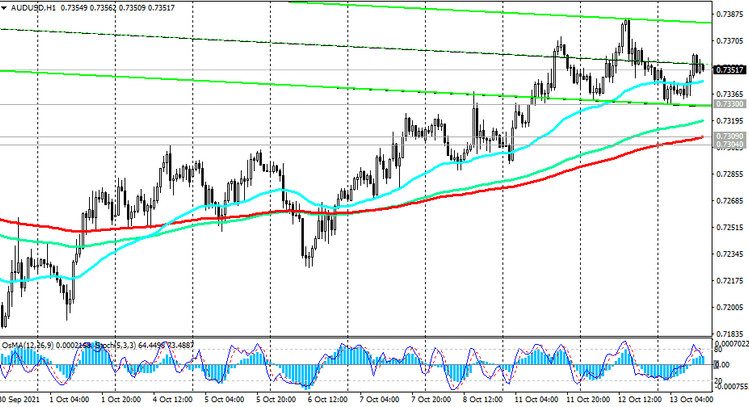

Today AUD / USD is growing for the third week in a row, bouncing off the local 5-week lows near the 0.7175 mark, reached at the end of last month.

At the time of publication of this article, AUD / USD is traded near 0.7350 mark, above important short-term support levels 0.7304 (EMA200 on the 4-hour chart), 0.7309 (EMA200 on the 1-hour chart), also trying to gain a foothold in the zone above the long-term support level 0.7330 (EMA50 on on the daily chart, EMA200 on the weekly chart). Nevertheless, despite the current growth, AUD / USD still remains in the bear market zone, below the key resistance level 0.7430 (ЕМА144, ЕМА200 on the daily chart).

Breakdown of short-term support levels 0.7309, 0.7304 will be a signal for the resumption of short positions with intermediate targets at support levels 0.7175, 0.7037 (38.2% Fibonacci retracement to the wave of the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510), 0.6900 (lower line of the descending channel on the weekly chart).

In an alternative scenario, AUD / USD will continue to rise towards the resistance level 0.7430. However, only a breakdown of the resistance level 0.7510 (50% Fibonacci level) will indicate the resumption of the long-term upward trend in AUD / USD and its return to the bullish long-term market.

Support levels: 0.7330, 0.7309, 0.7304, 0.7200, 0.7175, 0.7115, 0.7037

Resistance levels: 0.7400, 0.7430, 0.7480, 0.7510

Trading Recommendations

Sell-Stop 0.7325. Stop-Loss 0.7375. Take-Profit 0.7309, 0.7304, 0.7200, 0.7175, 0.7115, 0.7037

Buy Stop 0.7375. Stop-Loss 0.7325. Take-Profit 0.7400, 0.7430, 0.7480, 0.7510