The dollar is actively declining on Tuesday. As of this writing, DXY futures are traded near 93.57, 100 pips below the local 13-month high reached last week and 36 pips below today's opening price.

Market participants assess the prospects for the Fed's monetary policy, which is extra-soft and will remain so even after the November meeting of the US central bank, at which its leaders are expected to reduce the volume of purchases in the bond market, which is currently $ 120 billion a month.

At the same time, market participants fear that the energy crisis will spur inflation, which is already well above the 2% target set by the Fed.

A September report from the Bureau of Labor Statistics, released last Wednesday, indicated that consumer inflation remained elevated last month, which in turn was also fueled by a sharp rise in energy prices (electricity prices rose 1.3% in September, for foodstuffs - by 0.9%, and for gasoline - by 1.2%). The consumer price index (CPI) rose 0.4% compared to August and 5.4% in annual terms. Energy prices continue to rise, and supply problems and critical commodity shortages persist.

According to another report, published earlier in October, the annual growth of the PCE (price index for personal consumption expenditure) was 4.3%, which is the highest in three decades (the Fed prefers this indicator to measure inflation).

The core consumer price index (Core CPI), which does not take into account volatile food and energy prices, rose 4% in September (on an annualized basis) after a similar increase in August. Annual inflation rates have remained the highest in the United States in 13 years since May 2021, putting pressure on the value of the dollar.

The pressure on the dollar is also increasing from the US labor market. The decline in the number of jobseekers in the labor market and the inability of employers to find new employees, despite the proposed higher salaries and other bonuses, postpone to a later date the prospect of a full recovery of the labor market and its return to pre-pandemic levels.

"For a number of non-monetary reasons, I do not expect employment to return to pre-coronavirus levels anytime soon", Fed representative Michelle Bowman said Wednesday.

Currently, the number of jobs in the country is almost 5 million lower than in February 2020. And the full recovery of the labor market is the determining factor for the FRS to start curtailing the stimulus program.

It seems that the market is getting used to the opinion that by the end of this year the Fed will begin to reduce the volume of purchases as part of its QE program, but this may no longer be enough to contain accelerating inflation. And if the Fed continues to be inactive on raising interest rates, then the risks of hyperinflation increase, which will then prove to be a very difficult task to contain.

The minutes of the September 21 and 22 Fed meeting released last week showed that only half of 18 executives expect interest rate hikes to be required by the end of 2022, and almost all executives foresee another rate hike in 2023.

Thus, despite the expected reduction in the volume of the stimulus program, the Fed's monetary policy remains soft, which is a negative factor for the dollar, although it remains a defensive asset against the background of the continued growth in the number of infected with COVID-19.

Meanwhile, the main competitor of the dollar in the currency market, the euro, is strengthening against it, today for the 5th day in a row.

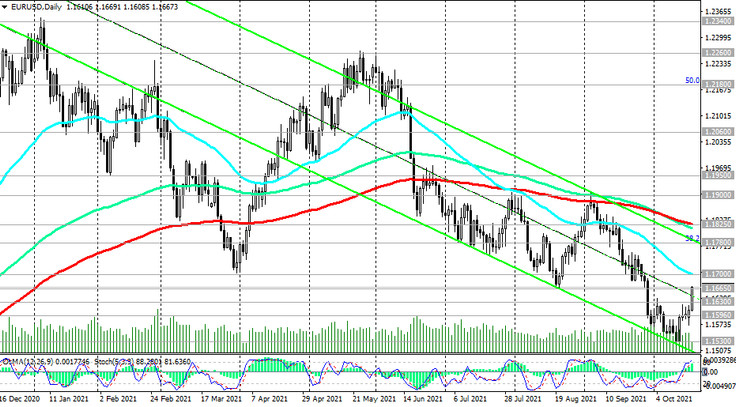

At the time of publication of this article, the EUR / USD pair is traded near a strong resistance level passing through the 1.1665 mark (see Technical Analysis and Trading Recommendations).

Despite its weakness, the euro is receiving support from the expectations of some economists and market participants that at the October 28 meeting, ECB leaders will be able to clarify the prospects for the bank's monetary policy after the end of the PEPP program and even hint at the possibility of restricting purchases under the broader QE program.

Inflation in the Eurozone, as well as in other economically developed regions of the world, continues to grow, by now significantly exceeding the target levels of the ECB.

And yet, the growth of the EUR / USD pair can be attributed to the weakening of the dollar rather than to the strengthening of the euro, which is actively declining in cross-pairs with major currencies such as NZD, AUD, CAD, GBP.

Therefore, the most probable scenario seems to be that the EUR / USD will return to a downtrend if the dollar's weakening stops. Based on this our statement and from the point of view of technical analysis, EUR / USD will face strong resistance near the 1.1700 mark if the pair can overcome the 1.1665 resistance level at which it is currently located.

Today, market participants trading the EUR / USD pair will pay attention to the speeches of the representatives of the central banks of the Eurozone Elderson, Panetta, Lane (at 11:00, 12:00 and 14:00 GMT) and the USA Bowman and Waller (at 17:15 and 19:00 GMT).

At 12:30 (GMT), fresh statistics will be presented on the bookmarks of new homes in the United States, which are expected to decline slightly in September, which may negatively affect USD quotes in the short term.