"The inflation we are seeing is not really caused by a shortage of labor. It is caused by supply disruptions, a shortage of raw materials and very strong demand", said Federal Reserve Chairman Jerome Powell during a press conference following a regular US central bank meeting on Wednesday, dedicated to the issues of monetary policy.

"Inflation is at elevated levels, which broadly reflects factors that are expected to be temporary", the Fed said, noting that "the imbalance in supply and demand associated with the pandemic and the opening of the economy contributed to significant price increases in some sectors".

Thus, as follows from the central bank statement, the Fed leaders still view the rise in inflation as a temporary phenomenon, and those inflationary pressures will ease over time.

Nevertheless, the US Federal Reserve approved a plan to phase out the asset purchase program (this process will begin in November and should be completed by June next year), although it has left interest rates at the same level, close to zero values (target range for the federal funds rate remained the same, 0.00% -0.25%).

The Fed will cut bond purchases by 15 billion in November and another 15 billion in December, the central bank said on Wednesday. According to its management, such a reduction in the volume of acquired assets "is likely to be appropriate every month", although it is ready to adjust the pace of curtailing purchases, "if it is justified by the changes in the outlook for the economy".

At the press conference, Jerome Powell reiterated that the central bank will not rush to raise interest rates, as the labor market has not yet fully recovered, and the increased inflation in the Fed is still considered a temporary phenomenon.

According to economists, inflation has been above the Fed's interest rates for a long time. They also believe, in contrast to the Fed's leadership, that the recent acceleration in inflation is not temporary and is not related to supply chain disruptions, and the Fed is in a difficult situation: a cut in the asset purchase program could slow GDP growth in the face of a fragile economic recovery due to pandemic.

And yet, market participants now believe that given high inflation, the Fed will raise interest rates in the summer of 2022, after completing the bond purchase program, and then again or two later next year.

The dollar fell on Wednesday after the FRS meeting: market participants expected a tougher decision from its leaders. However, the dollar is growing again on Thursday. As of this writing, DXY futures are traded near 94.27, just 30 pips below the local 13-month high reached in mid-October.

One way or another, the Fed has nevertheless begun to roll back its stimulus policy, and this process is likely to proceed at a faster pace than in other major world central banks.

Last year, the Fed formulated the conditions under which an increase in interest rates would be justified: inflation should aim at a moderate excess of 2%, and the labor market should return to the state it was in before the pandemic began. Now we see that inflation is well above the Fed's target of 2%, and perhaps this is not temporary, as the Fed believes. At the same time, the American labor market continues to recover, and positive macro data continues to come from the country.

Thus, according to ADP data published on Wednesday, 571,000 new jobs were created in the US private sector in October, which is higher than the economists' forecast of +400,000.

At the same time, the ISM purchasing managers' index (PMI) for the US services sector, which was also published on Wednesday, rose to 66.7 in October (against the forecast of 62.0 and the previous value of 61.9), reaching a record high in many years.

On Thursday (at 12:30 GMT) fresh weekly data on initial jobless claims in the United States will be published, the number of which, according to economists, will fall to 277 thousand, which is also a positive factor, indicating an improvement in the state of the American labor market. Nevertheless, tomorrow's release (at 12:30 GMT) of monthly data on US nonfarm payrolls will be of key importance (for the Fed and market participants). Economists expect another increase in the number of jobs created in October, to 425 thousand from 194 thousand last month, and a decrease in the unemployment rate by another 0.1%, to 4.7%, which will be further evidence of the ongoing recovery of the American labor market. These are encouraging indicators for US stock market participants and dollar buyers.

Also at the same time (12:30 GMT) on Friday, Statistics Canada will publish data on the country's labor market for October. Unemployment has risen in Canada in recent months, including amid massive business closures due to coronavirus and layoffs. Unemployment rose from the usual 5.6% - 5.7% to 7.8% in March and already up to 13.7% in May 2020. If unemployment continues to rise, the Canadian dollar will decline. If the data is better than the previous value, the Canadian dollar will strengthen. A decrease in the unemployment rate is a positive factor for CAD, an increase in unemployment is a negative factor. In August, unemployment was at the level of 7.1%, and in September 6.9% (against 7.5% in July, 7.8% in June, 8.2% in May, 8.1% in April). According to the forecast, it is expected that unemployment in Canada in October remained at the same level of 6.9%, and the number of employed increased by 19.3 thousand. This is moderately positive data for CAD, whose quotes may grow supported by renewed growth in oil prices after their decline in the previous 2 trading sessions.

Canada is the largest exporter of oil, and the share of oil and oil products in the country's exports is approximately 22%. Despite some uncertainty in the oil market due to the spread of the delta strain of the coronavirus, many leading economists predict a further increase in energy prices (coal, gas, oil), including due to expectations of a cold winter and rush demand in the gas market.

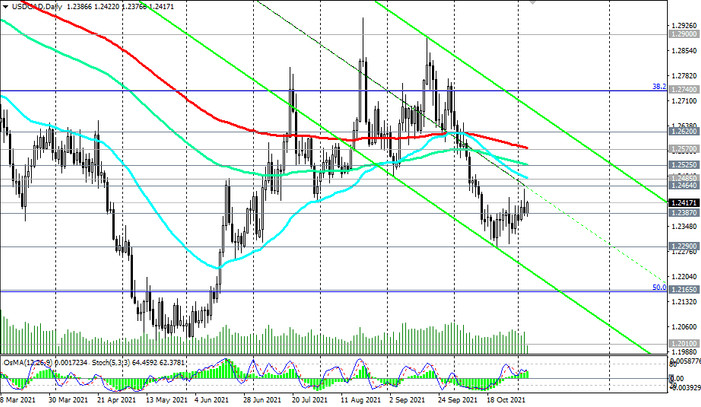

Thus, on Friday at 12:30 (GMT), a sharp increase in volatility is expected in the financial markets and, above all, in the USD / CAD pair. If the official data of the US Department of Labor turns out to be disappointing, then we should expect a weakening of the US dollar and a decline in USD / CAD.