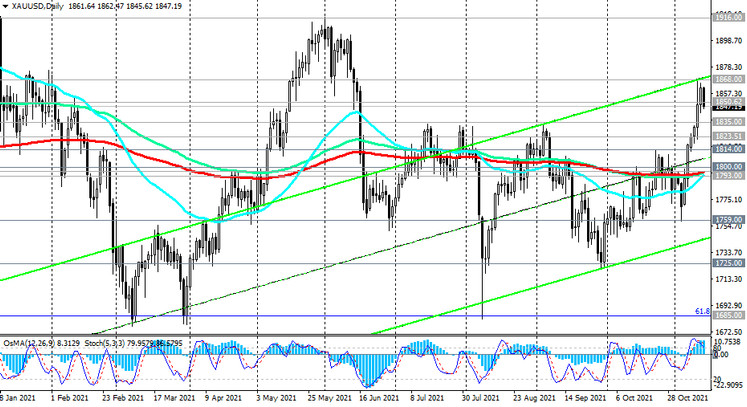

As we noted above, the XAU / USD pair rose sharply in the week of November 8-14. Since the beginning of the month, the increase has made more than 3.5%. The growth of the pair accelerated after the publication of CPI indices, which indicated a sharp rise in inflation in the United States. The consumer price index jumped 6.2% in October (on an annualized basis), the strongest growth in more than 30 years. Gold is a traditional defensive asset, including against inflationary risks, and investors have preferred it in the current situation.

Above the key support levels 1800.00, 1797.00 (ЕМА200 on the daily chart), 1793.00 (ЕМА50 on the weekly chart), XAU / USD remains in the bull market zone, and the breakdown of the local resistance level 1868.00 (highs reached this week) will create preconditions for further growth of the pair.

In an alternative scenario, corrective decline will continue to the important short-term support level 1823.00 (ЕМА200 on the 1-hour chart). Its breakdown may trigger a deeper decline to the key support levels 1800.00, 1797.00, 1793.00.

More distant targets of decline are located at support levels 1685.00 (Fibonacci level 61.8% of the correction to the wave of growth since November 2015 and the level of 1050.00), 1615.00 (ЕМА200 on the weekly chart). A breakdown of the support level 1560.00 (50% Fibonacci level) will increase the risks of the XAU / USD transition into a long-term downtrend.

Support levels: 1850.00, 1835.00, 1823.00, 1814.00, 1800.00, 1797.00, 1793.00, 1759.00, 1725.00, 1685.00, 1615.00, 1560.00

Resistance levels: 1868.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

Trading recommendations

Sell Stop 1840.00. Stop-Loss 1863.00. Take-Profit 1835.00, 1823.00, 1814.00, 1800.00, 1797.00, 1793.00, 1759.00, 1725.00, 1685.00, 1615.00, 1560.00

Buy Stop 1863.00. Stop-Loss 1840.00. Take-Profit 1868.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00