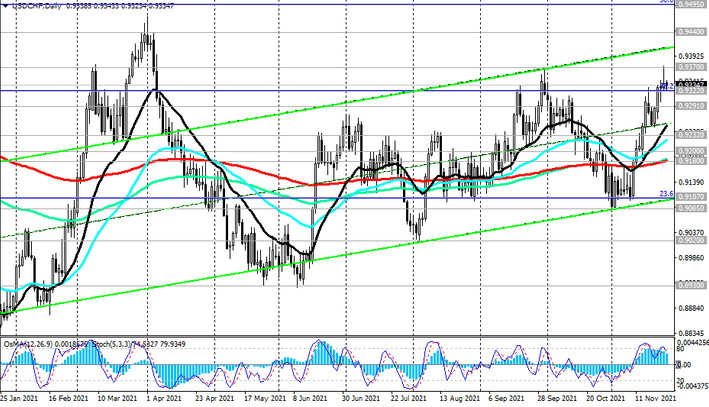

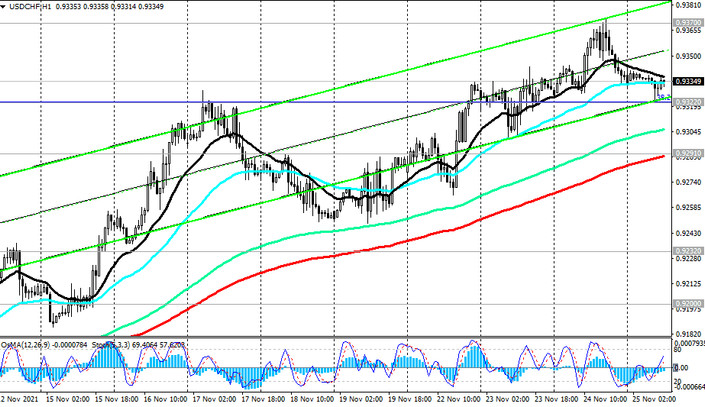

Since the beginning of this month, USD / CHF has been growing, building on the upward momentum that emerged at the beginning of the year. At the beginning of today's European session, USD / CHF is traded near 0.9335 mark, bouncing from yesterday's local and intra-monthly highs near 0.9370 mark, through which an important long-term resistance level (ЕМА144 on the weekly chart) passes.

The trend towards further growth in USD / CHF remains, and technical indicators OsMA and Stochastic on the daily and weekly charts are also signaling this.

In case of further growth and breakdown of the resistance level 0.9370, the next targets will be the resistance levels 0.9440 (ЕМА200 on the weekly chart), 0.9495 (Fibonacci level 50% of the correction to the decline wave that began in April 2019 near the level 1.0235). Between 0.9370 and 0.9440 marks, there is also the upper border of the ascending channel on the weekly chart. Thus, the zone of resistance levels 0.9370, 0.9440, 0.9495 is key for USD / CHF. The breakdown of the resistance levels 0.9440, 0.9495 will indicate the return of USD / CHF into the zone of the long-term bull market.

In an alternative scenario, the first preferable sell signal will be the breakout of the important short-term support level 0.9291 (ЕМА200 on 1-hour chart). The breakout of the support levels 0.9200, 0.9180 (ЕМА200, ЕМА144 on the daily chart) will return USD / CHF into the long-term bear market zone.

In the current situation, the main scenario of further USD / CHF growth is preferable.

Support levels: 0.9322, 0.9291, 0.9232, 0.9200, 0.9180, 0.9107, 0.9085

Resistance levels: 0.9370, 0.9440, 0.9495, 0.9670

Trading scenarios

Sell Stop 0.9315. Stop-Loss 0.9375. Take-Profit 0.9291, 0.9232, 0.9200, 0.9180, 0.9107, 0.9085

Buy by-market, Buy Stop 0.9375. Stop-Loss 0.9315. Take-Profit 0.9400, 0.9440, 0.9495, 0.9670