After the massive sell-off on the global stock market last Friday, during today's Asian trading session, investors and market participants overestimated the severity of the risks that arose after reports of a new more infectious strain of coronavirus found in South Africa, and global stock indexes rose, rebounding from multi-week lows reached at the end of last week.

Last Friday, European stock indices fell by about 5% amid information about the identification of a new strain of coronavirus. In Europe, in particular in Germany, the incidence continues to rise steadily, despite the vaccination campaign of the population. The information that cases of infection with new "omicron" strain appeared in this country caused a sharp negative reaction from investors, who began to actively sell European securities, which, in turn, caused a sharp strengthening of the euro (this currency is the funding currency on the European asset market). The shares of the transport, tourism and oil sectors were hit particularly hard. Some countries have imposed travel restrictions in regions where the spread of the new strain of coronavirus has been recorded, and the low trading volume associated with the Thanksgiving celebration in the United States on Thursday has increased volatility in the thin market.

The DXY dollar index rallied during today's Asian trading session, bouncing off 5-day lows near 96.00 hit Friday. However, at the beginning of the European session, it went down again. As of this writing, DXY futures are traded near 96.20.

In the current environment, gold quotes went up again. The Fed's monetary policy is a strong deterrent to the rise in gold prices, but its leaders may take a break: uncertainty is reinforced again by the emergence of a new strain of coronavirus. As you know, gold quotes are very sensitive to changes in the monetary policy of world central banks, especially the Fed. Gold does not generate investment income, but it is highly demanded in times of uncertainty. And now is exactly the case.

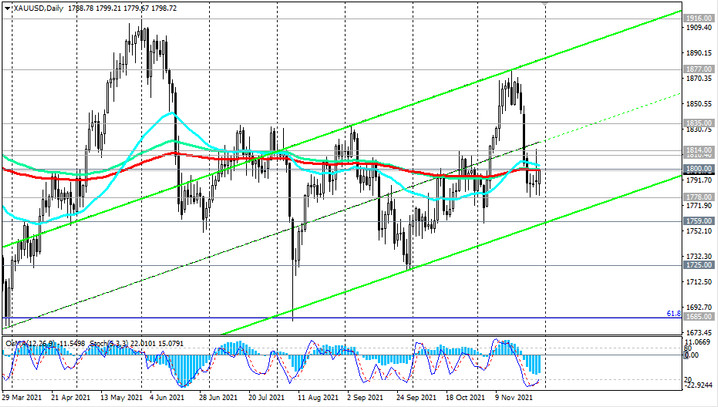

The growing fears about the return of large-scale anti-covid restrictions due to the emergence of a new omicron strain and the likelihood of maintaining the current monetary policy by the leading central banks of the world create a favorable background for the growth of gold quotes, which are again trying to break into the bull market zone above the psychologically significant mark of $ 1,800.00 per oz. But to open new buy trades, it is probably still better to wait for a more confident growth in XAU / USD, for example, above the mark of 1815.00, which corresponds to the recent local highs, while an important short-term resistance level in the form of a 200-period moving average on the 1-hour chart passes through the 1814.00 mark. A breakdown of the local support level 1778.00 will indicate the resumption of the downward dynamics of XAU / USD.

Returning to the previously mentioned topic of the FRS monetary policy, today investors will follow the speech of the Fed Chairman Jerome Powell, whose comments may affect both short-term and long-term trading of USD and, accordingly, the XAU / USD pair. If he makes unexpected statements, then the volatility in trading in the financial markets may increase. If he also mentions in his speech about a new strain of coronavirus and threats of new lockdowns, which may suggest a pause in the Fed's QE program, the dollar will come under pressure and gold quotes will rise. Although, one should not expect a strong weakening of the dollar either. First, it still remains, like gold, a defensive asset, and secondly, the Fed has nevertheless begun to roll back its stimulating policy, outlining a gradual decrease in the volume of purchases in the bond market in the amount of 15 billion dollars a month. Powell's speech will begin at 20:05 (GMT), and financial market participants will carefully study his speech in order to catch signals in it regarding the further actions of the Fed.