The sales, which were triggered by reports of the detection of a new strain of the coronavirus "omicron" in South Africa, continue on the global stock exchanges.

The shares of companies related to transportation, travel and oil production were hit especially hard. Fears of market participants that a new, more contagious mutation of the coronavirus, discovered in South Africa, will cause further quarantine restrictions and undermine the growth of the global economy, provoked a sharp drop in global stock indices and commodity prices. So, futures for Brent crude oil fell in price only over the last 3 trading days by 12%, having fallen to the present moment to $ 71.40 per barrel, while WTI crude oil fell in price by 14%, to $ 68.00 per barrel by the time this article was published.

Asian and European stock indices fell sharply. Thus, the Japanese Nikkey225 moved into the medium-term bear market zone, declining by 7%, the Australian ASX200, European STOXX50, GER40, FTSE100 are also on the verge of breaking the bull market, dropping to key support levels (in the form of a 200-period moving average on the daily chart) and their breakdown will sharply increase the threat of breaking the bullish trend of the aforementioned indices.

The decline in major US stock indexes is not so pronounced, but it is also significant.

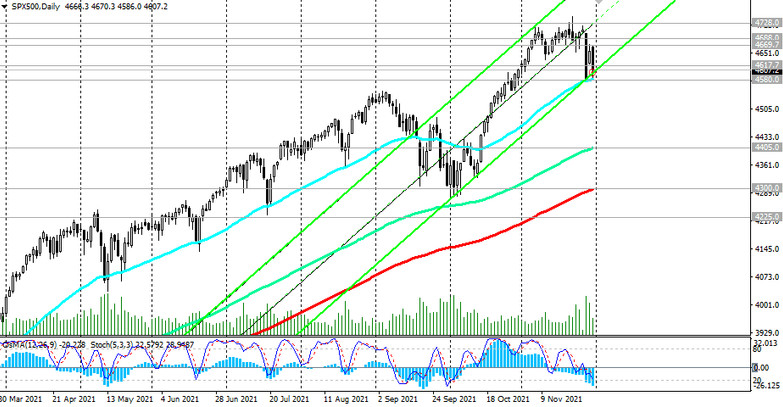

Last Thursday-Friday, the United States celebrated Thanksgiving, and in the thin market, in the absence of major players, futures for the major American stock indices NASDAQ, DJIA, S&P 500 also dropped significantly amid the same fears about a new more infectious strain of coronavirus. In particular, futures for the American broad market S&P 500 index lost 2.5% last Friday, dropping to a strong support level 4580.0. Correction was observed in the world stock market yesterday. Market participants tried to re-assess the degree of threat to the global economy from the new strain of coronavirus, and many global stock indexes rebounded from local lows, almost half having won back losses incurred on Friday. Nevertheless, the decline in the indices resumed on Tuesday. In particular, futures for the American S&P 500 index dropped from the opening of today's trading day by more than 1.4%, returning into the zone of strong support levels 4580.0, 4600.0.

Investors are concerned about reports from pharmaceutical companies that previously developed and applied vaccines against Covid-19 will not be as effective against the new omicron strain. Yesterday, US President Biden tried to calm the country's population, saying that the White House administration, together with vaccine manufacturers, is developing plans to combat the new strain of coronavirus. He also said the omicron was "not a cause for panic".

However, if the governments of the leading economically developed countries begin to introduce lockdowns again, the degree of tension will rise again. In fact, investors' fears about the immediate prospects for the global economy are growing, which is reflected, in particular, in a sharp increase in demand for traditional defensive assets such as the yen, franc, gold and government bonds.

Thus, the yield on US 10-year government bonds today fell sharply again after falling over the previous several days, which indicates an increase in demand for them and their value, and the price of gold is again testing the psychological resistance level $ 1,800.00 per ounce. At the time of publication of this article, the yield on 10-year US bonds was near 1.426%, which is in line with the levels of the 1st decade of November.

Fed Chairman Powell said Monday that "the omicron creates uncertainty for the outlook for inflation", and "fears of the virus could slow labor market progress and exacerbate supply chain problems".

Jerome Powell will speak to members of the Senate Banking Committee today. In the text of his speech, it is said that the spread of a new strain of coronavirus could exacerbate problems in supply chains, which have become one of the reasons for the strong rise in inflation. US Treasury Secretary Janet Yellen will also take part in the hearings.

Powell’s comments raise doubts that the Fed will soon begin to tighten policy. Earlier, economists predicted an increase in interest rates immediately after the completion of the Fed's quantitative easing program in the middle of next year, which contributed to the strengthening of the dollar. Now the doubts that have arisen about such prospects for the Fed's monetary policy due to the new strain of coronavirus provoke a weakening of the dollar, and today the DXY dollar index is declining again after a fairly strong fall last Friday. As of this writing, the DXY is near the 95.70 mark, which corresponds to the levels of 10 days ago.

Powell's speech is scheduled to begin at 15:00 (GMT). Most likely, if he again expresses fears that the spread of a new strain of coronavirus threatens to slow the economy, then the sentiment of market participants will only worsen from this. Conversely, the optimistic tone of Powell's speech can give confidence to investors and stop the fall of indices. At the very least, a steady rise in the S&P 500 into the zone above the resistance level 4617.0 (see "Technical Analysis and Trading Recommendations") will be a signal for the resumption of long positions. Otherwise, a breakdown of the 4580.0 support level could trigger a further decline in the S&P 500.