As reported last Friday in the US Department of Labor, the number of jobs outside agriculture in the country increased by only 210,000 in November, while the forecast assumed an increase of 550,000, and in October, according to the revised data, 546,000 work places were created. The data showed that employment growth slowed in November to its lowest level since December last year.

The DXY dollar index fell sharply immediately after the publication of the US Department of Labor report.

However, investors focused not on the NFP, but on data on employment and unemployment, which fell by another 0.4% in November, dropping to 4.2%, which also turned out to be better than the forecast of 4.5%. The share of Americans working or looking for work in November rose to 61.8% from 61.6% in October, which indicates the return of some potential workers to the labor market.

At the moment, a new potential threat has emerged in the American and global economies due to the omicron strain Covid-19. In the event of a new wave of morbidity, Americans may choose not to leave their homes to go to work or shop, which will lead to a slowdown in economic growth.

Market participants attached more importance to the fall in unemployment and an increase in the share of the economically active population, and the DXY dollar index rebounded shortly after its fall, returning to the middle of the range between the local multi-month high of 96.94 and the local low of 95.54, reached earlier last week.

As of this writing, DXY futures are traded near 96.31 mark, 20 pips above Friday's close, with potential for further gains towards recent multi-month highs near 96.44 reached in late November.

During the September meeting, FRS leaders predicted that unemployment in October-December will average 4.5% -5.1%. The unemployment rate fell to 4.2% in November, according to data released on Friday, and if the threat of new lockdowns turns out to be less severe, then another drop in the US unemployment rate in November means that the Federal Reserve may still accelerate the phasing out of assets purchases during the meeting in December. And this is a strong fundamental factor that speaks in favor of the possibility of further strengthening of the dollar.

No critical macro statistics are scheduled for the economic calendar today. Probably, investors will still overestimate the results of the report of the US Department of Labor published last Friday and the prospects for the market and the dollar.

Volatility and trading volumes will return to the market on Tuesday, when China's foreign trade balance data and the results of the RB Australia meeting with its decision on the interest rate will be published at the beginning of the Asian trading session.

The main negative factors for the Australian economy are weak wage growth, a weak labor market and a slowdown in growth, while unemployment in the country has remained above the 5% level for many years, unwilling to decline. Now, the Australian economy is experiencing difficulties due to the coronavirus pandemic, which has hurt tourism and transport hard.

It is expected that at this meeting the Central Bank of Australia will leave the rate at the current level of 0.1%, although unexpected decisions are not ruled out.

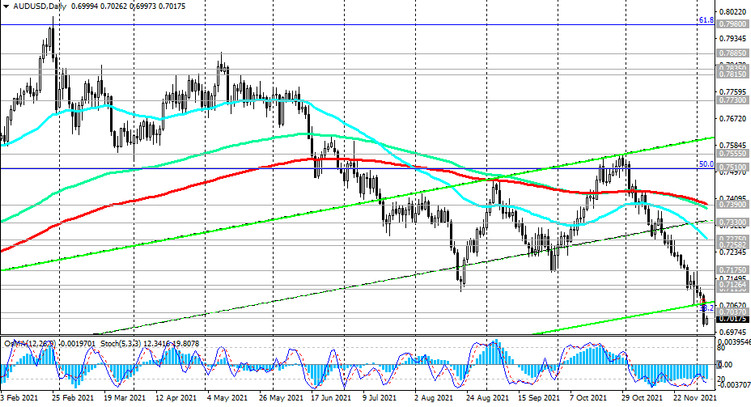

In an accompanying statement, RBA executives will explain the reasons for the rate decision. If the RBA signals the possibility of easing monetary policy in the near future, the risks of a fall in the Australian dollar will increase. Conversely, the harsh rhetoric of the accompanying RBA statement could provoke a strengthening of the Australian dollar. However, in the AUD / USD pair, it will be short-lived. The impact of the American dollar in comparison with the Australian dollar on the world economy and capital flows is incomparable. And the decisive role in the dynamics of AUD / USD from the point of view of the monetary policies of the FRS and the RBA will be played by the FRS. Since June, AUD / USD has been declining, remaining in a long-term downtrend. And, despite today's correction (the AUD / USD quotes rose during today's Asian session to an intraday high of 0.7026, returning some of the positions lost last Friday), a further fall in this currency pair should be expected. Recall that the RBA's decision on the interest rate will be published on Tuesday at 03:30 (GMT).