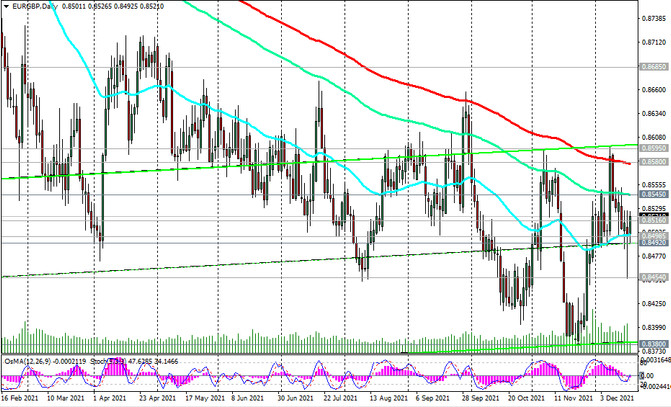

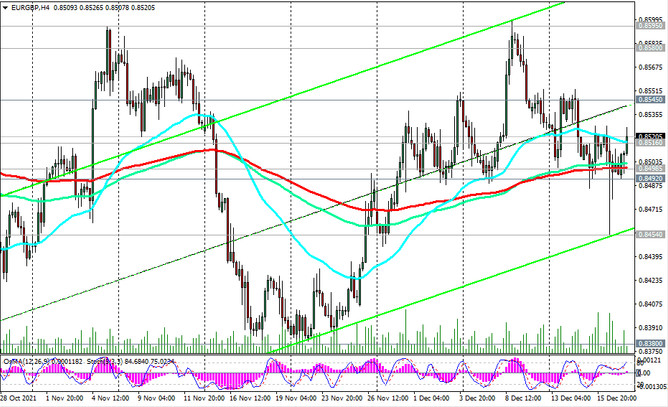

At the start of today's European trading session, EUR / GBP rallies in response to the release of German producer price indices and the final estimate of the Eurozone's annual consumer price index, signaling accelerating inflation. As of this writing, the EUR / GBP pair is traded near 0.8520, attempting to break through the important short-term resistance level 0.8516 (EMA200 on the 1-hour chart). If it manages to continue the corrective growth, then the target may become the resistance level 0.8545 (ЕМА144 on the daily chart). As long-term downtrend prevails, growth above the key resistance level 0.8580 (ЕМА200 on the daily chart) and the resistance level 0.8595 (the upper border of the descending channel on the weekly chart) is unlikely.

The downtrend prevails, clearly expressed by the descending channel on the weekly chart. Its lower border lies between the support levels 0.8380 and 0.8330. A return under the 0.8516 level is most likely. The breakdown of support levels 0.8498 (ЕМА200 on the 4-hour chart), 0.8492 (local support level) will be a signal to build up short positions towards support levels 0.8380 (ЕМА144 on the monthly chart), 0.8330 (lows since July 2016). A break of the key long-term support level 0.8230 (ЕМА200 on the monthly chart) could finally return EUR / GBP to the long-term bear market zone.

Support levels: 0.8498, 0.8492, 0.8454, 0.8380, 0.8330, 0.8230

Resistance levels: 0.8516, 0.8545, 0.8580, 0.8595, 0.8613, 0.8685

Trading Recommendations

Sell Stop 0.8490. Stop-Loss 0.8530. Take-Profit 0.8454, 0.8380, 0.8330, 0.8230

Buy Stop 0.8530. Stop-Loss 0.8490. Take-Profit 0.8545, 0.8580, 0.8595, 0.8613, 0.8685