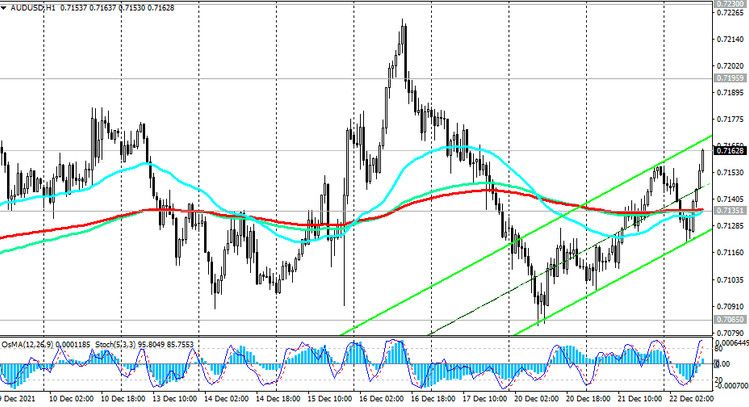

AUD / USD has risen since the beginning of this month, supported by the outcome of the December 7 RBA meeting. Meanwhile, the pair remains in the long-term bear market zone below the key resistance levels 0.7730 (ЕМА200 on the monthly chart), 0.7360 (ЕМА200 on the daily chart), 0.7320 (ЕМА200 on the weekly chart).

A further decline in AUD / USD is most likely from both a technical and a fundamental point of view. A signal for new sales will be a breakdown of the short-term support level 0.7135 (ЕМА200 on the 1-hour chart), and then the local support level 0.7085. The lows of the recent next wave of decline are located near the level of 0.5510.

In an alternative scenario, corrective growth may continue towards the resistance levels 0.7196 (ЕМА200 on the 4-hour chart), 0.7230 (ЕМА50 on the daily chart).

However, only a rise into the zone above the key long-term resistance level 0.7360 (ЕМА200 on the daily chart) will indicate the resumption of the long-term bullish trend in AUD / USD. Immediate growth targets after that will be located at resistance levels 0.7510 (Fibonacci level 50% retracement to the wave of the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510) and near the local 3-month high of 0.7555, reached at the end of October.

Support levels: 0.7135, 0.7085, 0.7037, 0.7000

Resistance levels: 0.7196, 0.7230, 0.7320, 0.7360

Trading Recommendations

Sell Stop 0.7115. Stop-Loss 0.7215. Take-Profit 0.7085, 0.7037, 0.7000, 0.6900, 0.6800, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Buy Stop 0.7215. Stop-Loss 0.7115. Take-Profit 0.7230, 0.7320, 0.7360