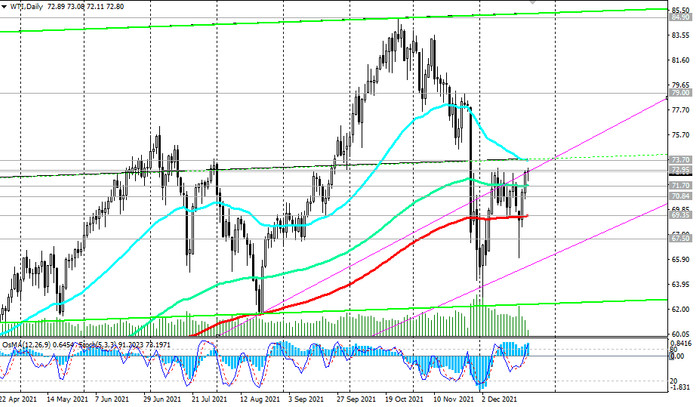

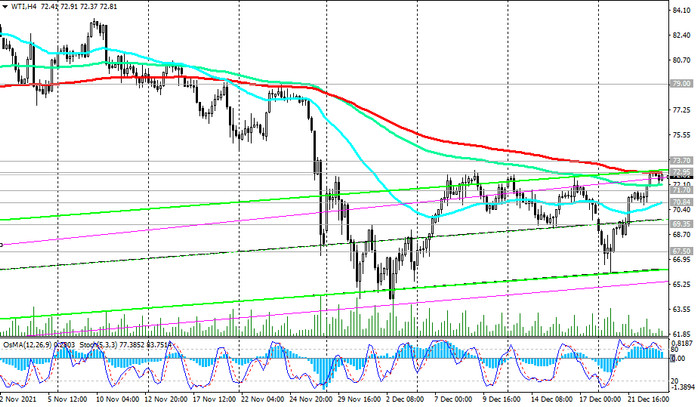

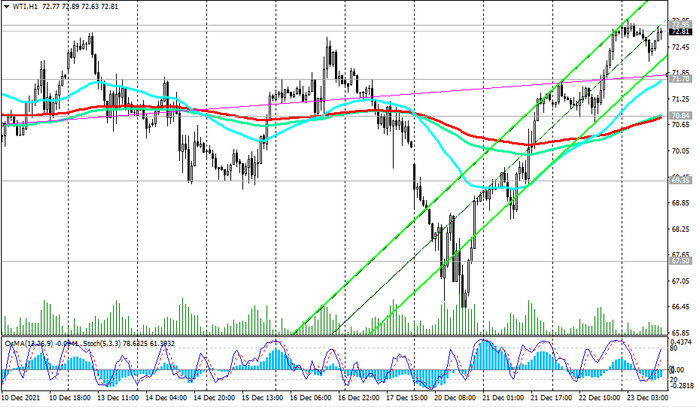

As we noted above, yesterday the prices for WTI crude oil continued their recovery, bouncing off the key support level 69.35 (ЕМА200 on the daily chart) dollars per barrel.

If the growth continues, the nearest target will be the resistance level 73.70 (ЕМА50 on the daily chart), the breakdown of which will open the way for further price growth. The maximum growth target is still at the local resistance level 84.90 (October highs and multi-year highs). If the global economy continues to recover, and fears about the coronavirus decline, then there is reason to expect further price increases.

In an alternative scenario, the price will still break through the support level 69.35 and head towards the long-term support level 57.50 (ЕМА200 on the weekly chart). The breakout of the key support level 53.00 (ЕМА200 on the monthly chart) will finally return prices to the bear market zone.

The first signal for the implementation of this scenario may be a breakdown of the support level 71.70 (ЕМА144 on the daily chart).

Support levels: 72.00, 71.70, 70.84, 69.35, 67.50, 57.50, 53.00

Resistance levels: 72.95, 73.70, 79.00, 84.90

Trading recommendations

WTI Oil: Sell Stop 71.60. Stop-Loss 73.20. Take-Profit 70.84, 69.35, 67.50, 57.50, 53.00

Buy Stop 73.20. Stop-Loss 71.60. Take-Profit 73.70, 79.00, 84.90, 86.00, 90.00