As we noted in our previous reviews, the dollar will maintain positive dynamics and potential for further growth. Following the results of the last meeting this year, which ended on December 16, the leaders of the FRS announced the acceleration of the pace of curtailing the program of stimulating the economy. This will allow it to be completed by March next year and to start raising the interest rate in the spring of 2022. The Fed plans to raise interest rates three times next year, while other major global central banks will lag behind the US central bank in this process. The growing divergence of monetary policy trajectories in the US and elsewhere in the world will drive demand for the dollar. Higher interest rates and the course for further tightening of the FRS monetary policy will provide significant support to the US dollar.

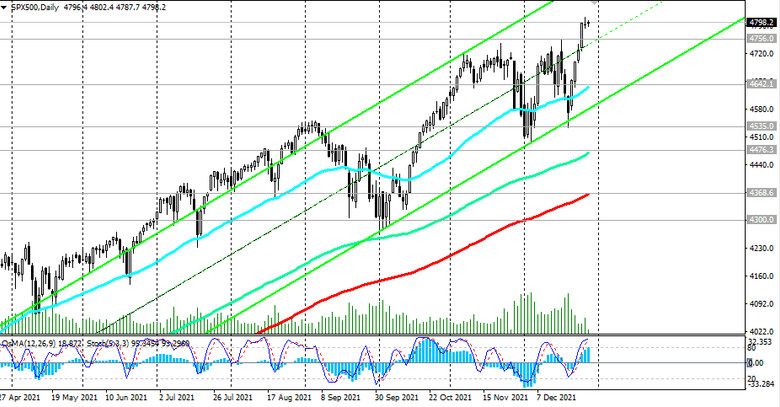

At the same time, the dollar, as the national currency of the United States, will be needed for purchases of American assets by foreign investors. And they, these assets, continue to grow in value. The positive dynamics of the US stock market assets is evidenced, in particular, by the S&P 500 broad market index, which reached a new record high of 4810.0 yesterday, and today its futures rose slightly again during the Asian trading session, exceeding yesterday's closing price.

In this situation, it would be logical to assume the strengthening of commodity currencies, first of all, such as the Canadian, New Zealand, Australian dollars, since the growth of stock indices, if this is not a blowing up of a bubble against the background of stimulating policies of the state and the central bank, speaks of economic growth. Well, since the American economy is the largest economy in the world, excluding the Chinese, its growth, primarily in the manufacturing sector, and the positive forecasts of economists in this regard imply an increase in demand for commodities and, accordingly, an increase in quotations of commodity currencies.

However, not everything is so simple here either. If the situation in the global economy improves or remains relatively stable, then the accelerating divergence of the trajectory of the Fed's monetary policy with the course of other major central banks in the world, as we noted above, will create preconditions for the further strengthening of the US dollar against its main competitors in the foreign exchange market. So far, only in the RB of New Zealand the interest rate is higher than all other interest rates of the world's major central banks and is at the level of 0.75%. In the United States, the main interest rate is at 0.25%, in Australia - at 0.1%. It is zero at the ECB, and negative in Switzerland and Japan.

But so far, only the Fed unambiguously signals about its leadership's propensity to triple interest rate hikes next year, unless a tougher approach is required against the backdrop of rapidly rising inflation.

If the situation in the global economy worsens or strong negative news appears, for example, regarding the coronavirus or geopolitics, then the dollar will again receive a basis for its strengthening, in this case, as a protective asset.

Based on the foregoing, in our opinion, the more correct decision would be to remain a buyer of the dollar, finding new opportunities to build up long positions on it. This, in particular, applies to the pair AUD / USD, which is currently traded near the mark of 0.7218. Staying below the important strong resistance level 0.7230, near which the upward correction may end, the pair remains inclined to resume its decline.

At a meeting in early December, the Reserve Bank of Australia left the key rate at 0.1%, noting that the conditions necessary for its increase would take some time. "The Board will not raise the key rate until inflation is stable in the 2% -3% range", said RBA Governor Philip Lowe. it will take some time and the board is ready to be patient".

However, many economists expect the bank to cut back on its bond purchases at its next meeting in February. The central bank may completely abandon quantitative easing amid a rapid economic recovery and persistent inflationary pressures. "At a meeting in February, the board will discuss the bond buying program", Lowe said.

Expectations that the RBA may also soon be on the path to accelerating withdrawal of stimulus policy and raising interest rates will support the AUD, but most likely not in the AUD / USD pair. A breakdown of the support level of 0.7200 will pave the way for a decline towards local multi-month lows near 0.7000, reached in early December. Next - we will look at the situation.