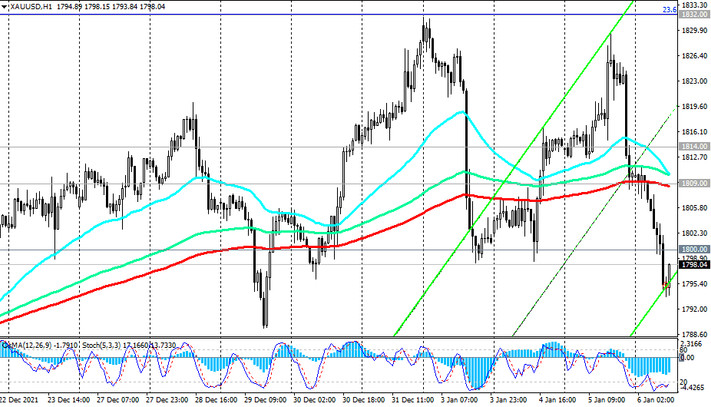

As we noted above, the XAU / USD pair is again testing the breakout of the important support level 1800.00 (ЕМА200, ЕМА144, ЕМА50 on the daily chart and ЕМА50 on the weekly chart). This mark, since about the beginning of 2021, has also become psychologically significant.

A confirmed breakdown of the 1800.00 support level could trigger a further decline in XAU / USD. After returning to the zone below 1785.00 (local support level), the XAU / USD decline will continue towards support levels 1752.00 (local lows), 1725.00 (the lower border of the descending channel on the daily chart), 1682.00 (38.2% Fibonacci level of the correction to the growth wave from December 2015 and mark 1050.00), 1635.00 (ЕМА200 on the weekly chart). A breakdown of the support level 1560.00 (Fibonacci level 50%) will increase the risks of breaking the long-term bullish trend XAU / USD.

In an alternative scenario, XAU / USD will resume its growth. However, to open new buy deals, it is probably still better to wait for a more confident growth of XAU / USD, for example, above 1809.00 and 1814.00, corresponding to recent local highs, while an important short-term resistance level passes through 1809.00 (ЕМА200 at 1 hour chart). In this scenario, the XAU / USD growth will continue towards the local maximum of 1916.00 and the upper border of the ascending channel on the weekly chart with intermediate targets at resistance levels 1832.00 (local highs and 23.6% Fibonacci level), 1877.00 (local resistance level).

Support levels: 1785.00, 1752.00, 1725.00, 1682.00, 1635.00, 1560.00

Resistance levels: 1800.00, 1809.00, 1814.00, 1832.00, 1877.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

Trading recommendations

Sell Stop 1784.00. Stop-Loss 1806.00. Take-Profit 1752.00, 1725.00, 1682.00, 1635.00, 1560.00

Buy Stop 1806.00. Stop-Loss 1784.00. Take-Profit 1809.00, 1814.00, 1832.00, 1877.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00