So, as we noted above, the further actions of the FRS leaders are still not completely predetermined, and against the background of the fact that some of the world's largest central banks (for example, the RB of New Zealand, the Bank of England) have already begun to raise their interest rates, the dollar will not grow be aggressive, although the DXY dollar index will retain the potential for further growth.

Today, market participants will study the report of the Department of Labor Statistics with the latest data on the dynamics of consumer prices, which will be published at 13:30 (GMT). December annual consumer inflation is projected to rise to 7.0%, an absolute high in 40 years (CPI excluding volatile food and energy prices is projected to rise +5.4% y / y in December after an increase of +4.9% in the previous month). If forecasts come true, then the dollar may rise sharply in the short term, including in the GBP / USD pair: these statistics may increase the propensity of the Fed leaders to raise interest rates in the coming months.

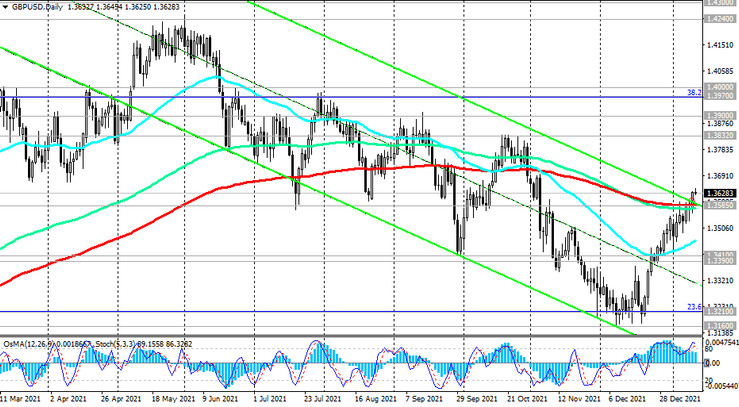

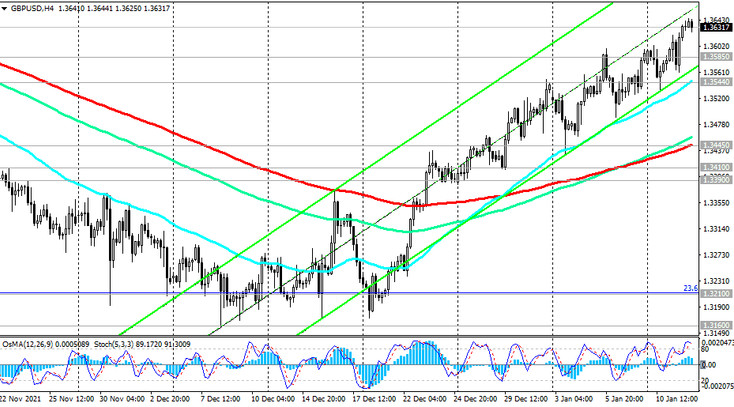

A breakdown of the key support level 1.3585 (ЕМА200 on the daily chart) and consolidation in the zone below 1.3585 will be a signal for a possible resumption of the decline in the GBP / USD pair and its return into a long-term downtrend. A breakdown of the key support level 1.3390 and support level 1.3210 (Fibonacci level 23.6% of the correction to the decline of the GBP / USD pair in the wave that began in July 2014 near the level of 1.7200) will finally return GBP / USD into a long-term downtrend.

Meanwhile, the pound remains the strongest of its major currencies in early 2022. It is supported by expectations of further increase in interest rates in the UK. Recall that the main interest rate of the Bank of England now is 0.25%, as well as in the FRS. However, the Bank of England is still ahead of the Fed in the process of tightening monetary policy by raising the interest rate back in December, and investors positively assess the success of the antiviral vaccination campaign in the UK and take into account in the pound quotes the further steps of the Bank of England in tightening monetary policy against the backdrop of strongly rising inflation in the country with positive macro-economic data.

Support levels: 1.3605, 1.3585, 1.3544, 1.3444, 1.3410, 1.3390, 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685

Resistance levels: 1.3645, 1.3700, 1.3832, 1.3900, 1.3970, 1.4000

Trading recommendations

GBP / USD: Sell Stop 1.3585. Stop-Loss 1.3650. Take-Profit 1.3544, 1.3444, 1.3410, 1.3390, 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685

Buy Stop 1.3650. Stop-Loss 1.3585. Take-Profit 1.3700, 1.3832, 1.3900, 1.3970, 1.4000