The second trading week of 2022 is coming to an end, which also turned out to be very volatile, like the first. The dollar will obviously end it in negative territory with a significant decline. Last Wednesday, when the US Department of Labor Statistics report was published with December data on consumer inflation, the DXY dollar index fell sharply, and, as we see, continued to decline today during the Asian trading session. As of this writing, DXY futures are traded near 94.75, in line with the September 2020 highs. Having broken through the lower limit of the range at 95.54 on Wednesday, the DXY dollar index fell sharply, reacting to the acceleration of inflation in the US.

The Department of Labor Statistics reported that consumer prices rose 7.0% (on an annualized basis) in December after rising 6.8% in November. This corresponds to highs almost 40 years ago. Core inflation (excluding food products and energy) rose in December by 5.5% (in annual terms).

Thus, inflation has been exceeding the Fed's target of 2% for several months in a row, and its growth at such a pace is forcing investors to fix long positions on the dollar: they fear that the Fed may be late with measures to tighten monetary policy. Market participants have already priced in 3 Fed rate hikes this year, and they seem to believe that this will not be enough to curb the soaring inflation in the US.

The dollar is still receiving support from the rising yield of US government bonds (at the time of publication of this article, the yield on 10-year US bonds was 1.739%, returning to levels almost a year ago). However, if it starts to decline, then a further fall in the dollar will become almost inevitable, unless the Fed announces emergency measures to curb inflation.

By the way, last Wednesday, one of the leaders of the Fed and the head of the St. Louis Fed, James Bullard, already spoke in favor of tougher measures. In his opinion, now, to contain high inflation, it is necessary to raise interest rates four times this year. "We want to get inflation under control in a way that doesn't hurt the real economy, but we are also determined to bring inflation back to our target of 2% over the medium term", Bullard said.

In the meantime, the dollar is rapidly declining, primarily in relation to its main competitors in the foreign exchange market, including in relation to commodity currencies. They, in turn, receive additional support from rising commodity prices.

Despite the continued increase in the number of cases of COVID-19 in the world, investors remain optimistic, the main world stock indices continue to show positive dynamics, and the statistical departments of most countries with leading economies in the world publish very optimistic reports with macroeconomic data.

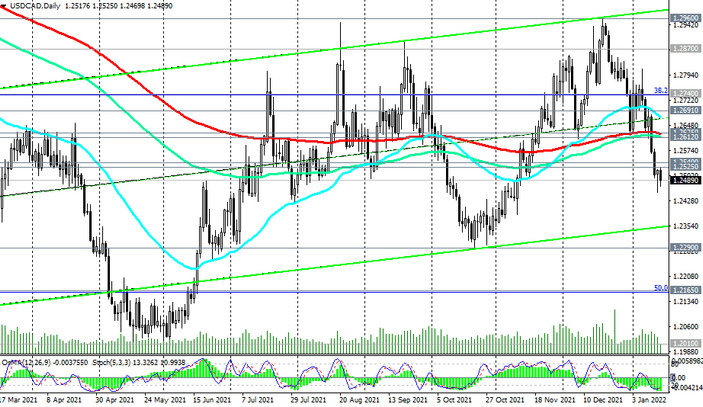

Of the major commodity currencies, the best dynamics against the US dollar is shown by the Canadian dollar, which receives significant support from the continuing rise in oil prices. Canada is the largest exporter of oil, and the share of oil and oil products in the country's exports is approximately 22%. Despite some uncertainty in the oil market due to the coronavirus, many leading economists predict a further increase in energy prices (coal, gas, oil), while gas prices have gone up again after a slight decline at the end of 2021, while there has been a reduction in stocks in US oil storage facilities for several weeks in a row. By the way, on the morning of January 14, exchange prices for natural gas in Europe again exceeded $1.1 thousand per 1 thousand cubic meters. On December 21, 2021, they reached a historic high of $2190.4 per 1,000 cubic meters, after which they began to decrease, and at the end of December the price fell to $1020.

According to a recent report by the Energy Information Administration of the US Department of Energy, on the weekly change in commercial stocks of oil and petroleum products, in the week of January 1-7 they decreased by 4.553 million barrels. Oil inventories declined for the seventh week in a row, and now US strategic oil reserves stand at 593.4 million barrels, down 300,000 barrels.