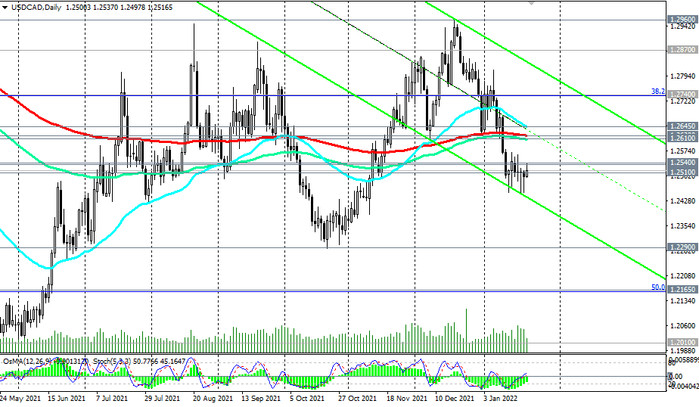

USD/CAD spent this week mainly trading in the range between the local support/resistance levels 1.2450/1.2565. Today it failed to overcome the important short-term resistance level 1.2540 (EMA200 on the 1-hour chart) and is falling again at the time of publication of this article.

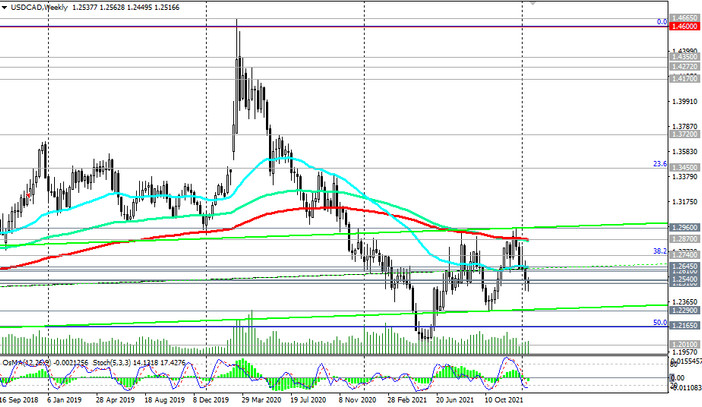

It is also worth paying attention to the monthly USD/CAD chart, where the price has come up against a strong support in the zone of long-term levels 1.2535, 1.2510 (200 and 144-period moving averages). Accordingly, from a technical point of view, a breakdown of the local support at 1.2450 and resistance at 1.2560 (weekly lows and highs) will indicate the direction of further USD/CAD dynamics.

In the meantime, short positions remain preferable: USD/CAD is in the bear market zone, remaining below the key resistance levels 0.2610, 0.2630 (144 and 200-period moving averages on the daily chart), 1.2870 (EMA200 on the weekly chart).

As for today's news, which will cause volatility in the market, primarily in CAD quotes, and hence the USD/CAD pair, it is worth paying attention to the publication of retail sales data in Canada at 13:30 (GMT): retail trade is the main indicator of consumer spending, and this is one of the main components in calculating the country's GDP.

Support levels: 1.2510, 1.2450, 1.2290, 1.2165, 1.2010

Resistance levels: 1.2535, 1.2540, 1.2560, 1.2610, 1.2620, 1.2645, 1.2740, 1.2870, 1.2900, 1.2960

Trading scenarios

Sell Stop 1.2490. Stop Loss 1.2550. Take-Profit 1.2450, 1.2400, 1.2290, 1.2165, 1.2010

Buy Stop 1.2550. Stop Loss 1.2490. Take-Profit 1.2560, 1.2610, 1.2620, 1.2645, 1.2740, 1.2870, 1.2900, 1.2960