Today's economic calendar is not limited to the Fed meeting. At 15:00 (GMT), the Bank of Canada will publish its interest rate decision.

According to data released by the National Bureau of Statistics, Canada's GDP in the 2nd quarter decreased by -3.2% (year-on-year), while economists had forecast its growth by 2.5%. The data for the 3rd quarter turned out to be much better: the annual GDP growth amounted to +5.4% (against the forecast of +3.0%). However, many economists have downgraded their 2021 growth forecast for the Canadian economy. The final data for the 4th quarter will be presented in March.

The negative effects of the coronavirus on the Canadian economy and the country's labor market, as well as the weakness of the housing market, are putting pressure on the Bank of Canada towards either further monetary easing or a wait and see attitude. It is expected that at today's meeting the Bank of Canada will keep interest rates at 0.25%.

The tough tone of the Bank of Canada's accompanying statement regarding rising inflation and prospects for further tightening of monetary policy will cause the strengthening of the Canadian dollar. If the Bank of Canada signals the need for loose monetary policy, the Canadian currency will decline. During the press conference, which will begin at 16:15 (GMT), the head of the Bank of Canada Tiff Macklem will explain the bank's position and assess the current economic situation in the country. During his speech, volatility in CAD quotes may also increase if he makes unexpected statements.

In the meantime, USD/CAD is declining, while the Canadian dollar is strengthening, also receiving support from rising oil prices. At the time of writing this article, USD/CAD is traded near 1.2576, testing a near-term support level (200-period moving average on the 1-hour chart) for a break.

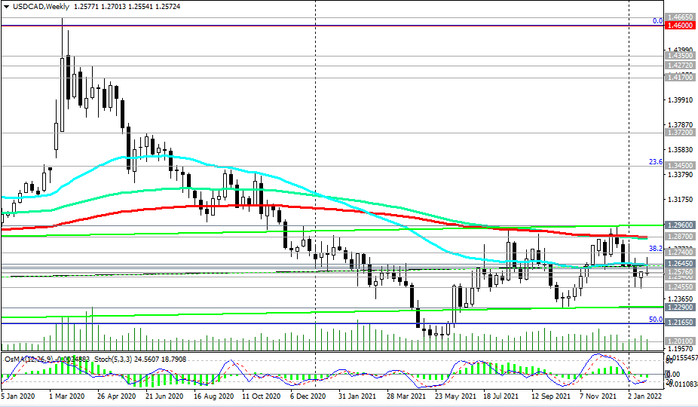

Looking at the weekly USD/CAD chart, another bearish "shooting star" candle is forming on it. Given the current downtrend, further decline is most likely: USD/CAD is in the bear market zone, remaining below the key resistance levels 1.2610, 1.2620, 1.2870 (EMA200 on the weekly chart).

An alternative scenario suggests a rebound from the support level of 1.2576 and a reversal.

Successive breakdown of resistance levels 1.2610 (EMA144 on the daily chart), 1.2620 (EMA200 on the daily chart), 1.2645 (EMA50 on the daily chart) will return USD/CAD to the bull market zone.

Support levels: 1.2576, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Resistance levels: 1.2610, 1.2620, 1.2645, 1.2740, 1.2870, 1.2900, 1.2960

Trading scenarios

Sell Stop 1.2550. Stop Loss 1.2635. Take-Profit 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Buy Stop 1.2635. Stop Loss 1.2550. Take-Profit 1.2645, 1.2740, 1.2870, 1.2900, 1.2960