At 13:30 (GMT), the latest data on inflation in the US and weekly data on the country's labor market will be published, which can determine (or clarify) the immediate prospects for the Fed's monetary policy. In view of this, at 13:30 (GMT) a surge in volatility is expected, and above all, in dollar quotes.

Meanwhile, today it is also worth paying attention to the speech (at 17:00 GMT) of the head of the Bank of England, Andrew Bailey. Last week, the Bank of England raised its key interest rate, further outperforming other central banks in the process of tightening monetary policy to curb accelerating inflation. The key rate was raised to 0.5% from 0.25%, and the bank said it expects annual inflation to accelerate to above 7% in the coming months due to low unemployment, rising wages and soaring energy prices. However, Bank of England officials are divided on how much to raise interest rates to contain accelerating price increases without dampening the economic recovery from the effects of the pandemic. Four of the nine members of the Monetary Policy Committee proposed to raise the rate to 0.75%.

From Andrew Bailey, market participants will be waiting for clarification of the situation regarding the further policy of the UK central bank. Probably, Andrew Bailey will also give an explanation regarding the decision made by the Bank of England on the interest rate and will touch upon the state and prospects of the British economy after Brexit and the partial lifting of quarantine restrictions due to the coronavirus. If Bailey does not touch on monetary policy issues, then the reaction to his speech will be weak.

Bailey's speech today comes ahead of tomorrow's release (at 07:00 GMT) of the UK's preliminary Q4 GDP estimate. After Brexit, British GDP growth slowed down, and with the onset of the global coronavirus pandemic, the indicator went into negative territory altogether.

According to the forecast, UK GDP is expected to grow in the 4th quarter of 2021 by +1.1% (previous indicator values: +1.1% in the 3rd quarter, +5.5% in the 2nd quarter after falling by -1.6% in Q1 2021). The main factors that could force the Bank of England to keep the rate low are weak GDP and labor market growth, as well as low consumer spending. In the event of rising inflation, British citizens will be forced to use their savings in order to maintain the level of consumption with a significant increase in prices. In the medium term, consumption could fall, in which case British GDP would come under pressure.

A strong report from the National Office of Statistics on GDP will strengthen the pound. But, if the GDP data turns out to be significantly worse than the previous values and the forecast, then this will put downward pressure on the pound.

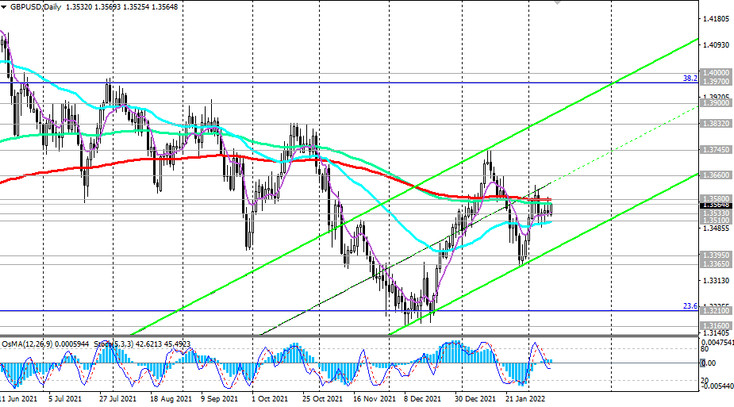

At the beginning of today's European session, GBP/USD is traded near 1.3566, showing a tendency to further growth.

In case of breakdown of the key resistance level 1.3580 (EMA200 on the daily chart), the target will be the local resistance level 1.3660 (local highs and the upper limit of the descending channel on the weekly chart).

A breakdown of the local resistance level 1.3745 may again increase the risks of breaking the GBP/USD bearish trend, sending the pair towards the highs of 2021 and the mark of 1.4200.