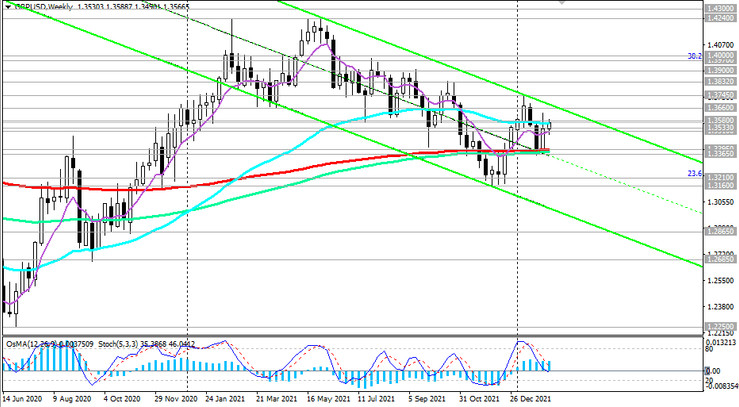

At the beginning of today's European session, the GBP/USD is traded near the 1.3566 mark, showing a tendency to further growth.

The pound strengthened immediately after the publication of the decision of the Bank of England on the rate last week, and GBP/USD reached a local intraday high of 1.3627. But then the pair turned to decrease, dropping to the support level 1.3510 (EMA50 on the daily chart). A retest of the support level 1.3510 is likely. In case of its breakdown, we should expect further decline towards support levels 1.3395 (EMA200 on the weekly chart), 1.3365 (local support level).

Breakdown of support levels 1.3210 (Fibonacci level 23.6% of correction to the decline of the GBP/USD pair in the wave that began in July 2014 near the level of 1.7200), 1.3160 (2021 lows) can finally return GBP/USD to the bear market zone and send the pair deep into the descending channel on the weekly chart with targets at local support levels 1.2865, 1.2685. More distant decline targets are at 1.2100, 1.2000.

In an alternative scenario, and after the breakdown of the key resistance level 1.3580 (EMA200 on the daily chart), the target will be the local resistance level 1.3660 (local highs and the upper limit of the descending channel on the weekly chart).

A breakdown of the local resistance level 1.3745 may again increase the risks of breaking the GBP/USD bearish trend, sending the pair towards the highs of 2021 and the level 1.4200.

Support levels: 1.3533, 1.3510, 1.3395, 1.3365, 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685

Resistance levels: 1.3580, 1.3660, 1.3700, 1.3745, 1.3832, 1.3900, 1.3970, 1.4000

Trading recommendations

Sell Stop 1.3520. Stop Loss 1.3610. Take-Profit 1.3510, 1.3395, 1.3365, 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685

Buy Stop 1.3610. Stop Loss 1.3520. Take-Profit 1.3660, 1.3700, 1.3745, 1.3832, 1.3900, 1.3970, 1.4000