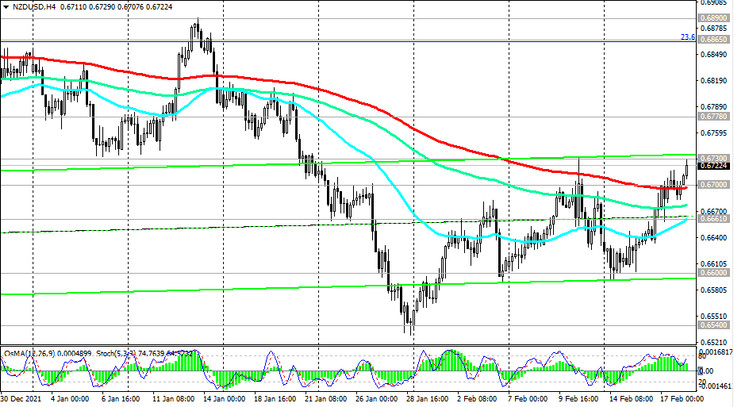

Despite the growth observed since the beginning of this month, NZD/USD remains in the bear market zone, trading below the key resistance levels 0.6865 (EMA200 on the weekly chart and the Fibonacci 23.6% of the correction in the global wave of the pair's decline from the mark of 0.8820), 0.6890 (ЕМА200 on the daily chart).

In January, NZD/USD hit a new 16-month low at 0.6540. However, there was no further decline, and the pair corrected, breaking through the important resistance level 0.6700 (EMA200 on the 4-hour chart and December lows) and closely approaching the resistance level 0.6730 (EMA50 on the daily chart).

The zone of levels 0.6700 and 0.6730 is a fairly strong resistance zone, for the breakdown of which and further growth, the NZD/USD pair will need solid grounds and fairly strong drivers. Until Wednesday, when the RBNZ meeting takes place, they are unlikely to appear, unless, of course, sellers of the US dollar want to lower its quotes in the thin market on Monday, when US banks and exchanges will be closed on the occasion of Presidents Day.

In this case, and after the RBNZ meeting on Wednesday, the NZD/USD has the prospect of growth towards the key resistance levels 0.6865, 0.6890.

In an alternative scenario, and after the breakdown of the support level 0.6700, NZD/USD will head towards the local support levels 0.6600, 0.6540 with the prospect of a deeper decline within the descending channel on the weekly chart.

In the current situation, the determining factor in the dynamics of NZD/USD is likely to be the course of the monetary policy of the central banks of the United States and New Zealand. And, most likely, the conditional "scale" will tilt towards the currency of the country whose central bank takes a tougher stance. In general, the downward dynamics of NZD/USD is still prevailing.

Support levels: 0.6700, 0.6661, 0.6600, 0.6540, 0.6500

Resistance levels: 0.6730, 0.6780, 0.6865, 0.6890, 0.6950, 0.7100, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

Trading recommendations

Sell Stop 0.6680. Stop Loss 0.6735. Take-Profit 0.6660, 0.6600, 0.6540, 0.6500, 0.6260

Buy Stop 0.6735. Stop Loss 0.6680. Take-Profit 0.6780, 0.6865, 0.6890, 0.6950, 0.7100, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600