Futures on European and US stock indices fell sharply, while oil quotes rose sharply after Russian President Vladimir Putin recognized the independence of the Donetsk and Luhansk People's Republics on Monday.

Officials from the White House and the European Union have already been quick to condemn Moscow's actions, calling them "a flagrant violation of international law". US President Joe Biden announced the introduction of new sanctions against Russia, while hopes for a possible summit of American and Russian leaders are finally fading.

Russia is the largest exporter of energy resources, and Ukraine is the largest transit country for gas to Europe. The escalation of tension in the region and the possibility of new sanctions against Russia, given the freezing of the Nord Stream 2 gas project, could lead to an even greater increase in prices.

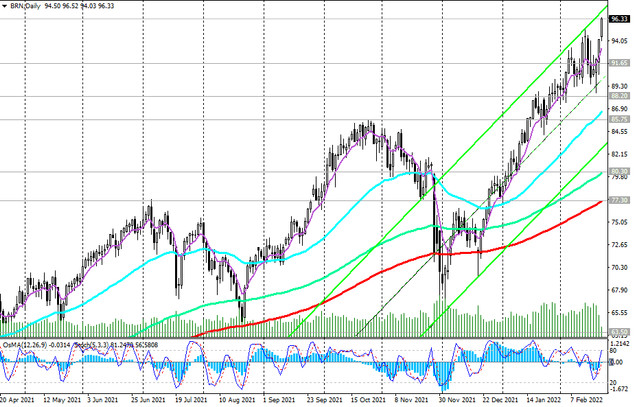

April Brent futures ended trading up 2% on Monday, posting the strongest single-day gain since Feb. 14. Natural gas prices traded up more than 8%.

At the beginning of today's European session, futures for Brent crude are trading near a multi-year high of 96.00 dollars per barrel, while the DXY dollar index remains in the middle of the range between the local maximum of 97.44 and a minimum of 94.61.

Oil prices may also receive support after Saudi Arabia's statements that there are signs of an increase in demand, which continues to outpace supply against the backdrop of a rather conservative position of OPEC+.

On Monday, US markets were closed for the celebration of Presidents' Day. The publication of important macro statistics is also shifted one day later. Thus, the weekly report of the Energy Information Administration of the US Department of Energy on the weekly change in commercial stocks of oil and petroleum products will be published not on Wednesday, as usual, but on Thursday (at 16:00 GMT). The previous report showed an increase in inventories (by +1.121 million barrels) after a more significant fall 2 and 3 weeks earlier. If the data points to a decline in US oil inventories, then this will give additional short-term impetus to oil prices.

In general, however, their upward momentum remains, and some oil market analysts warn that prices could exceed $100 a barrel if a war breaks out in Ukraine.

Of the news for today, market participants will pay attention to the publication in the period from 14:00 to 15:00 (GMT) of a block of important macro statistics for the US, including PMI Markit indices for activity in the manufacturing and services sectors of the American economy.

It is expected that the indicators for February will rise to 56.0 and 53.0, respectively. This is a positive factor for the dollar. In the event of supply disruptions, oil prices could pick up even if the dollar strengthens further.