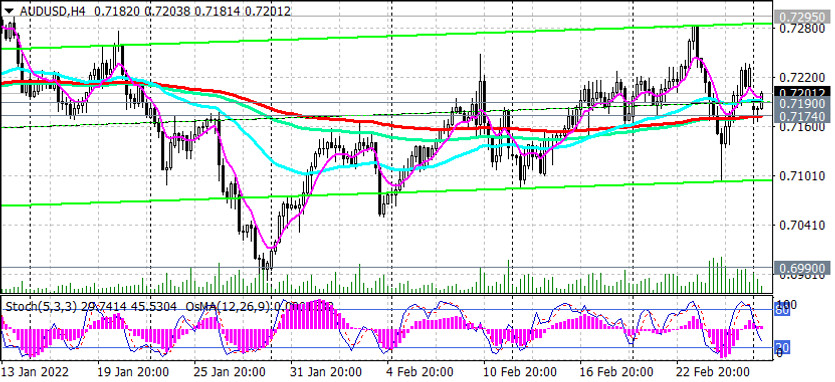

As we noted above, having received support from the positive macro statistics published this morning, the Australian dollar is developing an upward dynamics, and the AUD/USD pair, having broken through the important short-term resistance level 0.7190 (EMA200 on the 1-hour chart), is trying to grow towards the previous local maximum 0.7237.

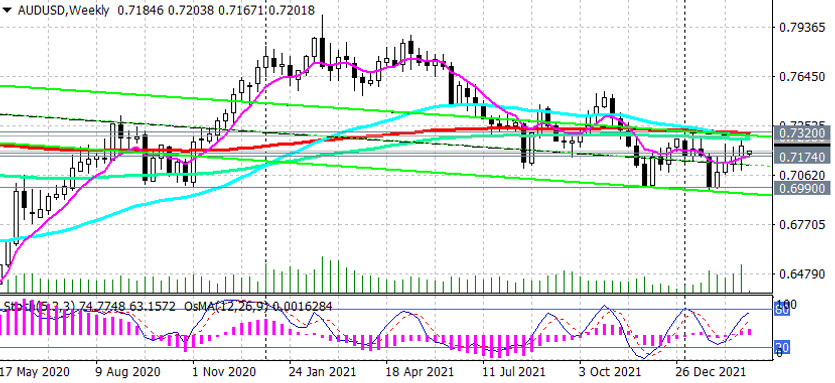

The main dynamics of AUD/USD is currently being built based on the dynamics of the US. Therefore, in the main scenario, we expect the AUD/USD to decline again, and the signal for this will be a breakdown of the support levels 0.7190, 0.7174 (EМА50 on the daily chart and ЕМА200 on the 4-hour chart). While AUD/USD remains in the global bearish trend zone, i.e. below the key resistance levels 0.7295 (EMA200 on the daily chart), 0.7320 (EMA200 on the weekly chart), short positions should be preferred. Only a breakdown of the resistance level 0.7320 can again turn the tide and bring AUD/USD into the bull market zone.

In case of a breakdown of the local support level 0.7085, the pair is waiting for a further deeper decline inside the descending channel on the daily chart. Its lower limit is below 0.6800. In this case, intermediate targets will be the support levels 0.7037 (Fibonacci 38.2% of the correction to the wave of the pair’s decline from the mark of 0.9500 in July 2014 to the lows of 2020 near the mark of 0.5510), 0.7000, 0.6970 (the lower limit of the descending channel on the weekly chart).

Support levels: 0.7190, 0.7174, 0.7160, 0.7085, 0.7037, 0.7000, 0.6970, 0.6900, 0.6800, 0.6455

Resistance levels: 0.7237, 0.7260, 0.7295, 0.7320

Trading Recommendations

Sell Stop 0.7165. Stop Loss 0.7215. Take-Profit 0.7140, 0.7100, 0.7085, 0.7037, 0.7000, 0.6970, 0.6900, 0.6800, 0.6455

Buy Stop 0.7215. Stop Loss 0.7165. Take Profit 0.7237, 0.7260, 0.7295, 0.7320