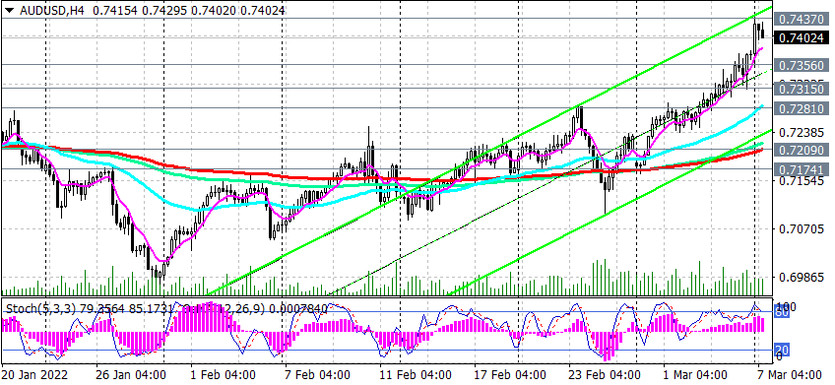

As we noted above, AUD/USD is developing an upward momentum, while AUD is receiving support from rising commodity prices, and USD is in demand as a safe-haven asset.

Today the 6th week of continuous growth of the pair has begun, which broke into the bull market zone - above the long-term key resistance levels 0.7295 ЕМА200 on the daily chart), 0.7315 (EМА200 on the weekly chart).

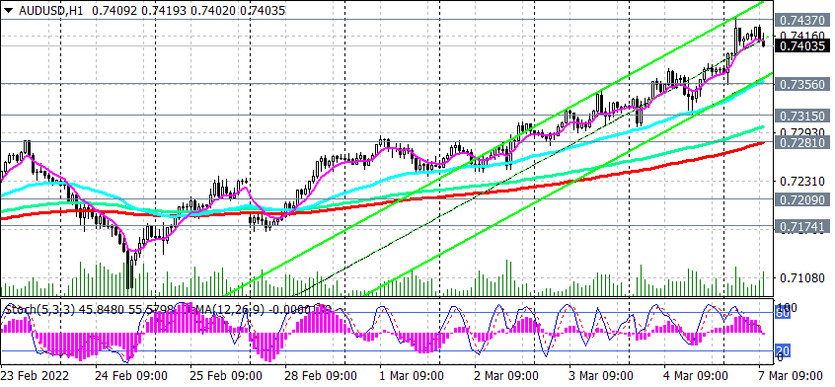

During today's Asian trading session, AUD/USD was able to rise to another local high of 0.7437, which corresponds to the levels of early November 2021. As long as the AUD\USD remains positive, above these key levels (0.7295, 0.7315) the advantage remains with long positions.

Breakdown of the local resistance level 0.7437 will be a signal to increase long positions. The growth target is a long-term resistance level 0.7775 (EMA200 on the monthly chart).

In the alternative scenario, we expect AUD/USD to resume its decline, and the signal for this will be a breakdown of the support level 0.7356 (today's low and ЕМА200 on the 15-minute chart).

A return into the zone below the key support levels 0.7295, 0.7315 will mean the return of AUD/USD to the global bearish trend zone.

Support levels: 0.7356, 0.7315, 0.7295, 0.7281, 0.7209, 0.7175, 0.7100, 0.7085, 0.7000, 0.6970, 0.6900, 0.6800, 0.6455

Resistance levels: 0.7437, 0.7555, 0.7775, 0.7900, 0.8000

Trading Recommendations

Sell Stop 0.7350. Stop Loss 0.7445. Take-Profit 0.7315, 0.7295, 0.7281, 0.7209, 0.7175, 0.7100, 0.7085, 0.7000, 0.6970, 0.6900, 0.6800, 0.6455

Buy Stop 0.7445. Stop Loss 0.7350. Take-Profit 0.7500, 0.7555, 0.7775, 0.7900, 0.8000