Despite the decline during the Asian session, the dollar seems to end this week in positive territory. Futures for the DXY dollar index are traded at the beginning of today's European session near 98.66, corresponding to levels almost 2 years ago.

The dollar, in particular, is supported by the rising yields of US government bonds. Thus, the yield on 10-year US bonds reached 2.417% this week, continuing to grow since August 2020.

The current levels correspond to the levels of May 2019, when the Fed interest rate was at the level of 2.50%. On the one hand, investors are actively withdrawing from protective government bonds, preferring the dollar. On the other hand, we can say that market participants are already taking into account the increase in interest rates by the Fed in prices. As you know, (in normal economic conditions) an increase in the interest rate and a tightening of the monetary policy of the central bank contributes to the strengthening of the national currency.

During his speeches this week, Fed Chairman Jerome Powell confirmed the possibility of a one-time increase in interest rates by 50 basis points at once. In total, Fed leaders are planning 6 more interest rate hikes this year. Thus, by the end of the year, the Fed interest rate should be at least 2% or more if it increases at Fed meetings not by 0.25%, but by 50%.

As for gold, it should be noted that it does not bring investment income, but is in active demand in the face of economic and geopolitical uncertainty. It is also in demand as a defensive asset in the face of rising inflation, and its quotes are extremely sensitive to changes in the policy of the world's largest central banks, primarily the Fed. When their interest rates go up, gold quotes tend to go down.

However, at the moment we are seeing an interesting picture.

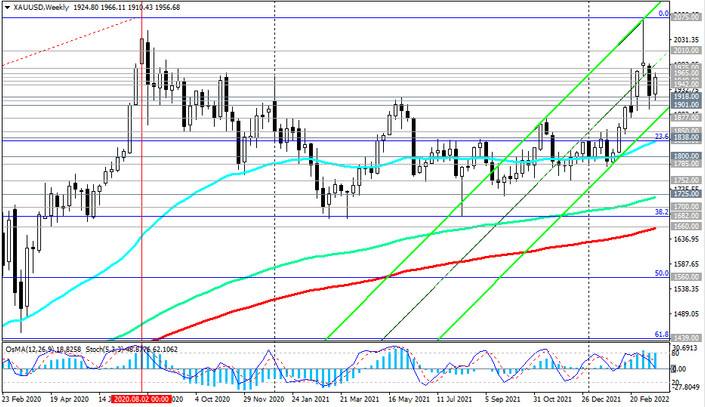

Despite the fact that the Fed has begun tightening its monetary policy, and some other major world central banks have signaled their willingness to follow this course as well, gold quotes are not declining, and this month they reached an almost 2-year high of $2070.00 per troy ounce. As a reminder, the all-time high closing was reached on August 6, 2020 at $2069.00.

There are several reasons for the growth of gold quotes. One of the main ones is the geopolitical tension in the world and the situation in Ukraine, where Russia is conducting a military special operation, and on the other hand, it is the accelerating inflation in the world.

As follows from the data published on March 10, the consumer price index (CPI) in the US in February rose by 7.9% (against 7.5% in January) compared to the same period last year, reaching the highest level in 40 years.

In Europe, inflation, which stood at 5.8% in February, nearly three times the ECB's target of 2%, is also accelerating rapidly, while the European Central Bank has been slow to act to contain it for fear of hurting the European economy. Tensions in Ukraine represent a stagflation shock for Europe, economists say. It raises the risks of a new recession due to the restriction of European exports, problems in supply chains and rising costs of energy, raw materials for households and the region's large industrial sector. Geopolitical tensions persist, given also the economic sanctions against Russia. The situation on the commodity markets also remains difficult, since the Russian Federation is one of the largest suppliers of oil and other energy resources to the European markets. Obviously, this tension will further fuel inflation, primarily in Europe. However, restrictive measures on Russian energy resources, primarily oil, create problems and for the United States, where the price of gasoline in a number of US states has overcome the $6 per gallon mark, and is likely to continue to grow, according to economists, further accelerating inflation.

Thus, despite the Fed's plans to further tighten monetary policy, there are no strong grounds for lowering the price of gold. On the contrary, many economists expect its growth to resume, especially if it becomes obvious that the Fed is unable to cope with rising inflation. Investors seem to perceive investing in the precious metal as a hedging tool and store of value, rather than as a speculative position.

One way or another, gold quotes are finishing this week in positive territory with an increase of about 1.5%, near the mark of 1957.00 dollars per ounce, despite the growth in yields of US government bonds and the dollar. In the current situation, it will be considered expedient to look for opportunities for the best entry into long positions. One of them, in our opinion, will be a decline to the levels 1949.00, 1942.00 and a breakdown of the level 1965.00.