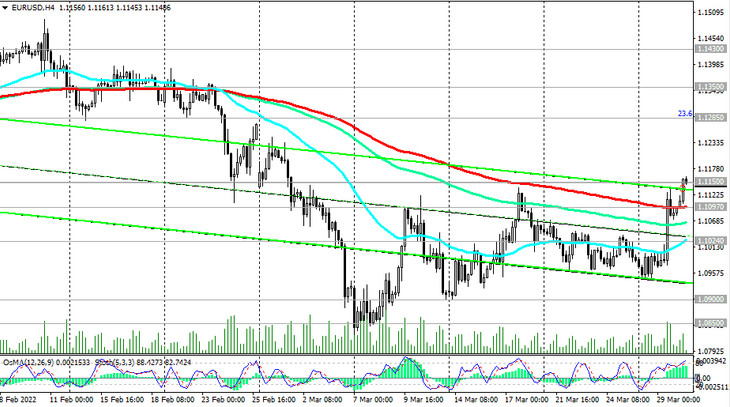

Against the backdrop of positive news regarding the outcome of negotiations between representatives of Ukraine and Russia, which ended in Turkey, the EUR/USD pair rose sharply on Tuesday, updating 4-week highs near 1.1136. Today the pair is also trying to develop an upward trend. Nevertheless, it will be difficult for it to break above the important resistance level 1.1150 (EMA50 on the daily chart) without additional drivers.

Most likely, the pair is waiting for a rebound near this resistance level and the resumption of decline. The driver of this decline can be the important macro data from the US published today (at 12:15 and 12:30 GMT), if they turn out to be positive for the dollar.

A break of the important short-term support at 1.1097 (EMA200 on the 4-hour chart) will be a signal to resume short positions on EUR/USD. However, aggressive market participants will probably find it possible to enter short positions on EUR/USD already from the current levels.

In the alternative scenario, corrective growth will continue. The signal for this will be a breakdown of the local resistance level 1.1161 (today's maximum), and the targets will be the resistance levels 1.1285 (Fibonacci level 23.6% of the upward correction in the wave of the pair's decline from the level 1.3870, which began in May 2014, to the level 1.0500), 1.1350 (local highs and ЕМА144 on the daily chart), 1.1430 (ЕМА200 on the daily chart).

However, only a breakdown of the long-term resistance level 1.1550 (EMA200 on the weekly chart) will return EUR/USD into the zone of the long-term bull market with the prospect of growth to the resistance level 1.1740 (EMA200 on the monthly chart).

Despite the current growth, so far we are sticking to the scenario for the resumption of EUR/USD decline.

Support levels: 1.1097, 1.1024, 1.1000, 1.0900, 1.0850, 1.0765, 1.0700, 1.0500, 1.0350

Resistance levels: 1.1150, 1.1200, 1.1285, 1.1300, 1.1350, 1.1430, 1.1500, 1.1550, 1.1740, 1.1780

Trading Recommendations

Sell by market. Sell Stop 1.1085. Stop Loss 1.1170. Take-Profit 1.1024, 1.1000, 1.0900, 1.0850, 1.0765, 1.0700, 1.0500, 1.0350

Buy Stop 1.1170. Stop Loss 1.1085. Take-Profit 1.1200, 1.1285, 1.1300, 1.1350, 1.1430, 1.1500, 1.1550, 1.1740, 1.1780