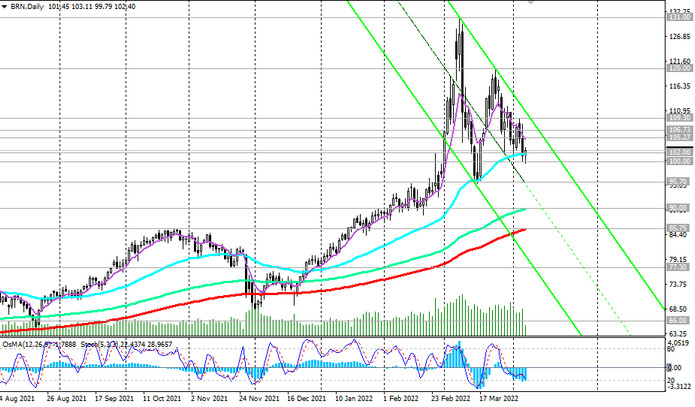

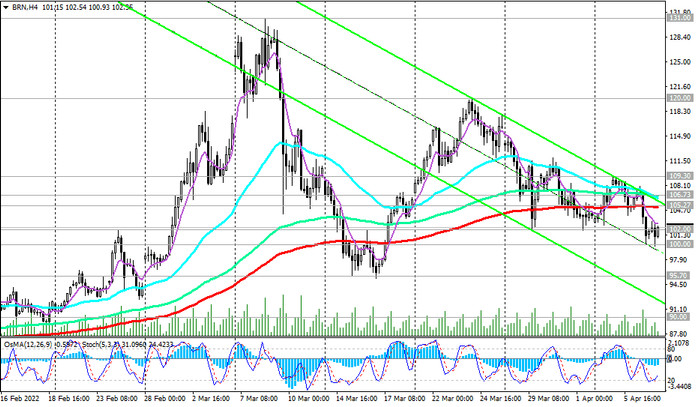

As we noted above, there is a downward correction in the oil market. Today the price of Brent crude fell to the mark of 100.00 dollars per barrel. However, the price has not gone below this psychologically significant level yet, returning to the zone above the support level 102.00 (EMA50 on the daily chart). The lower line of the ascending channel on the weekly chart also passes through this mark.

If our forecast for the resumption of growth is confirmed, then the nearest targets will be the resistance levels of 105.27 (EMA200 on the 4-hour chart), 106.73 (EMA200 on the 1-hour chart).

Breakdown of the local resistance level 109.30 will confirm the price return to the uptrend.

In an alternative scenario, and in case of a breakdown of the support level 100.00, the downward correction may continue to the key long-term support levels 90.00 (EMA144 on the daily chart), 85.75 (EMA200 on the daily chart) with an intermediate target at the local support level 95.70.

In our main scenario, price growth will resume from current levels. It is possible that now is the right moment to enter long positions and resume buying.

Support levels: 102.00, 100.00, 95.70, 90.00, 85.75, 77.30, 66.00

Resistance levels: 105.27, 106.73, 109.30, 114.00, 120.00, 130.00, 131.00

Trading recommendations

Brent: Sell Stop 99.30. Stop Loss 103.30. Take Profit 96.00, 91.00, 87.00, 77.30, 66.00

Buy Stop 103.30. Stop Loss 99.30. Take-Profit 105.00, 106.00, 109.00, 114.00, 120.00, 130.00, 131.00