"The stability of exchange rates is important, and their rapid changes are undesirable", Japan's Deputy Finance Minister Masato Kanda said recently, echoing statements made back in March by a government spokesman and finance minister.

BoJ Governor Kuroda also said today that the yen's fall was "somewhat rapid", which could be seen as a strong warning.

At the same time, many economists are warning of growing recession risks in the US due to a string of supply shocks, while the Fed raises rates to curb inflation.

The risk of a slowdown in business activity, along with dangerously high inflation, which reached 7.9% in February, poses a difficult task for the Fed. The central bank is trying to cool the economy by slowing down inflation, but not allowing spending cuts and rising unemployment.

In March, the Fed raised its key interest rate by a quarter of a percentage point and signaled six more hikes before the end of the year. This is the most aggressive pace of policy tightening in more than 15 years. Many economists and market participants expect two or more rate hikes of 0.50% at once before the end of 2022, assuming that by the end of 2022 the Fed's key interest rate midrange will be at 2.125%, and by December 2023 it will rise to 2.875 %. But this may no longer be enough to contain the accelerating rise in inflation.

High inflation remains the main risk to the economy, negatively affecting consumer purchasing power and sentiment, prompting the Fed to tighten policy more aggressively.

One need only look at the XAU/USD pair chart to understand the degree of investors' concern about the risks from inflation. Despite expectations of a more aggressive policy on the part of the Fed, gold prices are not declining, and today resumed growth. Gold quotes are extremely sensitive to changes in the policies of the world's largest central banks, primarily the Fed. When their interest rates go up, gold quotes tend to go down. But this is not observed. Gold is rising in price, despite the strengthening of the dollar.

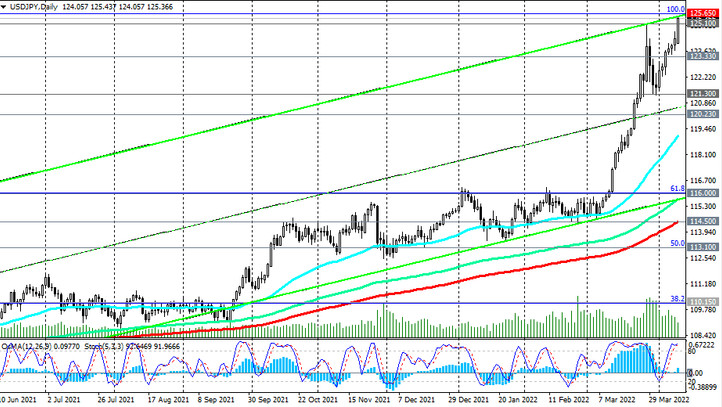

Returning to the USD/JPY pair, we can assume its further growth in the short and medium terms. So far, investors still prefer the dollar, while geopolitical tensions persist in the world (outside the US). Thus, last Friday the DXY dollar index updated a 2-year high at 100.19, and many economists agree that a breakdown of the psychologically significant level 100.00 will accelerate the further growth of DXY, and the dollar will continue to strengthen.

Today, USD/JPY is up sharply, posting a 6-week growth in a row to break above 125.10 (the high of last month and August 2015). The discrepancy between the monetary policy of the Fed and the Bank of Japan is likely to increase, creating preconditions for further growth of USD/JPY. In this case, the pair will head towards multi-year highs near 135.00, reached in January 2002 (see Technical Analysis and Trading Recommendations).