Today the Catholic world celebrates Good Friday. Banks and stock exchanges in these countries are closed. All important macro statistics, which are usually published on Friday, were published on Thursday. In particular, yesterday's preliminary consumer sentiment index of Americans in April amounted to 65.7 (versus 59.4 in March and the forecast of 59.0), while expectations about the economy and personal finances have improved.

While the index is still at its lowest levels since November 2011, as the spread of the micro-strain of coronavirus earlier in the year and high inflation caused sentiment to sharply deteriorate between January and March, April data marked the first improvement in consumer sentiment since December.

The one-year economic expectations indicator jumped 29.4%, while the personal finance indicator jumped 17.2%, according to the University of Michigan, which released the data. A strong labor market raised earnings expectations among consumers under 45 to 5.3%. This is the largest increase in the indicator for more than 30 years. "Consumers continue to expect the nationwide unemployment rate to decline slightly, which improves their assessment of the outlook for the national economy", University of Michigan economists said, even as "far too many sources of significant economic uncertainty remain".

John Williams, President of the Federal Reserve Bank of New York and FOMC Vice Chairman, said last night that raising interest rates by half a percentage point at the Open Market Committee meeting appears to be "a very reasonable option".

The need for one or more half percentage point rate hikes has been announced recently by other Fed officials. U.S. annual inflation hit a 40-year high of 8.5% in March, according to the latest data from the Department of Labor, and to combat accelerating inflation, “the Fed may have to raise rates above neutral levels”, according to Williams (the neutral interest rate, which does not stimulate or slow down the growth of the economy, is, according to Williams, in the range from 2% to 2.5%. Now the range of this rate is from 0.25% to 0.5%).

On Thursday, other important macro data for the US was also released. In particular, the US Department of Labor reported that the number of initial claims for unemployment benefits in the week of April 3-9 rose to 185,000 from 167,000 a week earlier (the lowest level since 1968). Secondary claims also remain near their lowest levels in more than 50 years. These data indicate a stable process of further improvement in the US labor market. And this, coupled with data on GDP and inflation, is the determining factor for the Fed in making decisions regarding monetary policy.

John Williams expressed confidence yesterday in the ability of the US economy to withstand higher interest rates and continue to grow.

One way or another, during yesterday's very volatile trading (recall that a regular meeting of the ECB was also held on Thursday - see our recent EUR/USD review), the dollar strengthened again, and the DXY dollar index rose to a new almost 2-year high of 100.77. There is very little room left before the level of 101.00 to exceed it. And, most likely, the level of 101.00 will soon be overcome, which will create prerequisites for further growth of DXY and, accordingly, the strengthening of the dollar.

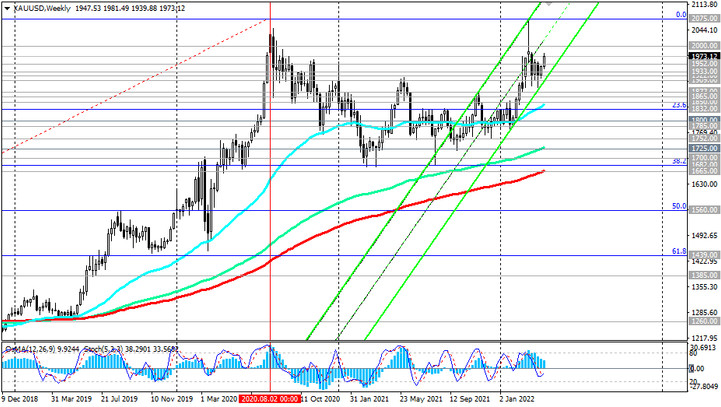

Despite the positive outlook for the dollar, gold, as we can see, is also growing in price, and the XAU/USD pair maintains a positive trend. Market participants remain cautious amid geopolitical risks, and also assess how successfully the Fed and other major central banks in the world will cope with actively growing inflation. But in the first place, of course, is the Fed. If inflation in the United States continues to grow, and the geopolitical situation remains tense, then, despite the increase in interest rates by the Fed (and gold quotes are extremely sensitive to changes in the policies of the world's largest central banks, primarily the Fed), the price of gold will again head towards the recent local maximum and the psychological mark of 2000.00 dollars per ounce. After overcoming this resistance level, the prospect of growth in gold quotes and the XAU/USD pair will expand up to 2075.00 (August 2020 high), 2100.00 (upper limit of the ascending channel on the weekly chart) - see "Technical analysis and trading recommendations".