As we wrote in one of our recent reviews (for 04/15/2022), “there is very little space left to the level 101.00 to exceed it. And, most likely, the level 101.00 will be overcome soon, which will create prerequisites for further growth of DXY and, accordingly, the strengthening of the dollar”. During today's Asian trading session, the 101.00 mark was reached, and although the DXY index fell back at the beginning of the European session from the reached level 101.00, the prospect of further growth of the dollar remains.

As New York Fed President and FOMC Vice Chairman John Williams said last week, raising interest rates by half a percentage point at a meeting of the Open Market Committee appears to be "a very reasonable option". Williams expressed confidence in the ability of the US economy to withstand higher interest rates and continue to grow.

The need for one or more half percentage point rate hikes has been announced recently by other Fed officials. U.S. annual inflation hit a 40-year high of 8.5% in March, according to the latest data from the Department of Labor, and to combat accelerating inflation, “the Fed may have to raise rates above neutral levels”, according to Williams (a neutral interest rate that does not stimulate or slow down economic growth, is, according to Williams, in the range from 2% to 2.5%. Now the range of this rate is from 0.25% to 0.5%).

While some of the world's other major central banks (notably the Bank of England, the RB of New Zealand, and the Bank of Canada) have also begun tightening their monetary policies, the Fed is leading the way. If the Fed's interest rate rises more rapidly, as, for example, John Williams calls for, by 0.5% (it is possible that even at every Fed meeting), then by the end of the year it may exceed 3.0%. The last time the rate was at this level in January of the 2008 crisis year, and in June 2006 it reached the level of 5.25%. I. e. the level of 3.0% for the Fed is quite acceptable.

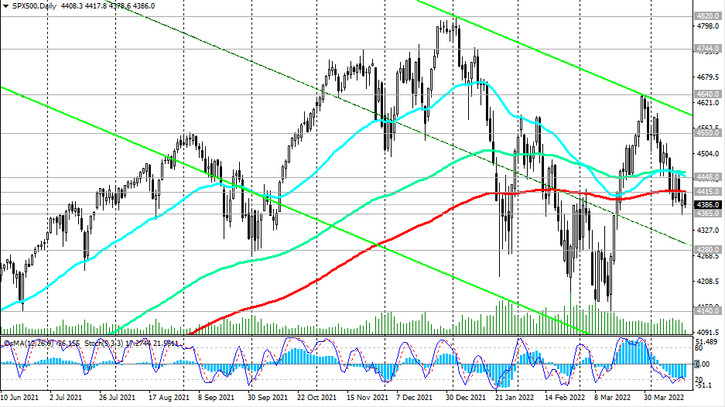

It is not yet clear how the US economy and the US stock market will react to this, but so far its major indices have been declining since the beginning of this month, today is the 3rd week in a row.

This decline, in part, may also be due to investors' fears regarding the introduction of new sanctions against the Russian economy, which not only have a negative impact on the Russian, European and American economies, but also threaten a new acceleration in inflation, in particular, due to rising energy prices and key food products, of which Russia is the largest supplier.

Today, trading activity remains to be reduced: some market participants probably still continue to celebrate Catholic Easter, and the publication of important macro statistics is not scheduled today. It will appear on Thursday, when the latest weekly data on the US labor market will be published at 12:30 (GMT).

Last Thursday, the US Department of Labor reported that the number of initial claims for unemployment benefits in the week of April 3-9 rose to 185,000 from 167,000 a week earlier (the lowest level since 1968). Secondary claims also remain near their lowest levels in more than 50 years. These data indicate a stable process of further improvement in the US labor market, which is also a positive factor for the dollar and US stock indices. Another decline in the indicator will also have a positive impact on them, albeit in the short term.

But the main attention of investors on Thursday will be focused on the speeches of Fed Chairman Jerome Powell (at 15:00 and 17:00 GMT). Financial market participants will carefully study Powell's speech in order to catch signals from him regarding the further actions of the Fed.

A more hawkish stance on the Fed's monetary policy is seen as positive for the dollar but negative for US stock indices. The harsher Powell's statements are, the more they may decline.

Of the news for today, which may still increase volatility in the market, market participants will pay attention to the publication (at 12:30 GMT) of statistics on the dynamics of home construction in the US in March.

A slight relative decline in the US Department of Commerce report is expected, which may negatively affect US stock indices, in particular the S&P 500.

Futures for the S&P 500 have been declining since the opening of today's trading day, as well as futures for the blue-chip Dow Jones Industrial Average and futures for the Nasdaq100 technology index.

The longer prices remain elevated, and the longer the fighting in Ukraine continues, the more likely there will be a tipping point where stocks could move into a long-term bear market, economists say. It is worth noting that investors continue to actively sell government bonds, expecting higher inflation and higher Fed rates.