"Inflation is too high, and we understand the difficulties it causes. We are taking swift action to bring it down," Fed chief Jerome Powell said during a press conference immediately after the release of the May 4 rate decision. As a result of this meeting, Fed leaders decided to raise rates by 0.50% and announced a reduction in the central bank's balance of assets (in the amount of $ 9 trillion), which will begin in June. The Fed will reduce its portfolio of Treasuries and mortgage-backed securities by just under $100 billion each month. Balance sheet shrinkage is one component of the Fed's monetary policy normalization program to slow inflation. Fed officials are focusing on changing short-term interest rates, but reducing the asset portfolio is also an important part of this process.

Today at 18:00 (GMT) the minutes from the May Fed meeting ("FOMC minutes") will be published. After the publication of the decision on interest rates, this is the second most significant event regarding the actions of the Fed. The publication of the minutes is extremely important for determining the course of the current policy of the Fed and the prospects for raising the interest rate in the United States, but since they may contain either changes or clarifying details regarding the results of the last meeting, volatility may increase sharply in financial markets (especially in dollar and US stock market assets) at the time of this publication.

At the time of publication of this article, futures for the DXY dollar index are traded near 102.23, 283 points below the local maximum (since January 2003) of 105.06, reached in the first ten days of May.

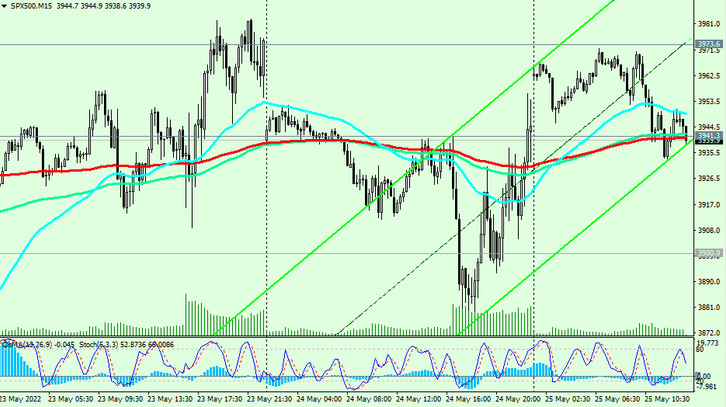

In general, the positive dynamics of the dollar and its DXY index remain. Accordingly, the dynamics of the main US stock indices remains negative (usually DXY has an inverse correlation to US stock indices). Thus, futures for the broad market index S&P 500 are currently traded near the level 3940.0, testing the short-term support level 3941.0 (EMA200 on the 15-minute chart) for a breakdown and signaling a tendency to further decline.

Volatility in quotes of the dollar and stock indices will also increase today at 12:30 (GMT), when the US Census Bureau report will be released with data on orders for durable goods, implying large investments. The report suggests further growth in orders in April, albeit at a slower pace than in the previous month: +0.6% versus +1.1% in March. Despite some slowdown, the data speaks of the continued recovery of the US economy, and this is a positive factor for the dollar and for US stock indices. However, the market's reaction to this publication may be restrained on the eve of the publication (at 18:00) of the minutes from the May Fed meeting.