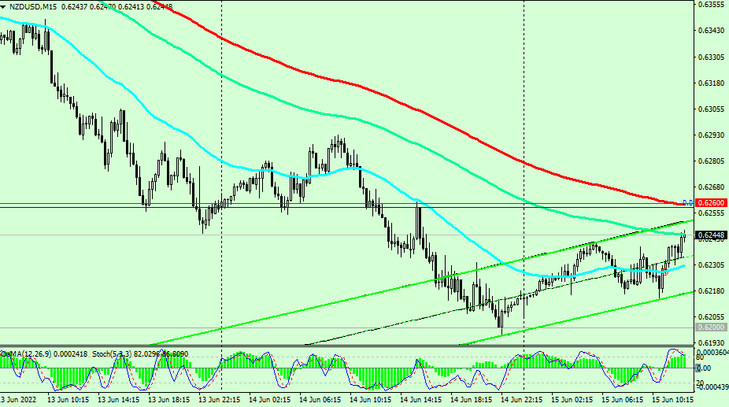

The NZD/USD is dominated by a strong negative momentum, provoked by a sharp strengthening of the US dollar. The fall of NZD/USD for the first 2 weeks of this month has already amounted to about 5%, after yesterday the price updated an almost 2-year low, breaking through 0.6200 level.

At the time of writing this article, NZD/USD is traded near 0.6245 mark, trying to develop an upward correction from the support level 0.6200. In case of a breakdown of the resistance level 0.6260 (EMA200 on the 15-minute chart and lows of the pair's decline wave in 2014-2015 from the mark of 0.8820), the pair will move higher towards the resistance levels 0.6368 (EMA200 on the 1-hour chart), 0.6458 (EMA200 at 4-hourly chart), 0.6495 (EMA50 and the upper limit of the descending channel on the daily chart). Growth above 0.6500 seems unlikely for the time being due to the strengthening of the USD against the background of the aggressive policy of the Fed, which is raising interest rates at an accelerated pace.

Most likely, NZD/USD is waiting for a further decline, and a breakdown of the support level 0.6200 will become a signal for building up short positions. In this case, the price will move lower, towards the lower border of the descending channel on the daily chart, which is currently passing near the 0.6000 mark.

Support levels: 0.6200, 0.6100, 0.6000

Resistance levels: 0.6260, 0.6300, 0.6368, 0.6400, 0.6458, 0.6495, 0.6540

Trading recommendations

Sell Stop 0.6190. Stop Loss 0.6270. Take Profit 0.6100, 0.6000

Buy Stop 0.6270. Stop Loss 0.6190. Take-Profit 0.6300, 0.6368, 0.6400, 0.6458, 0.6495, 0.6540, 0.6600