Last week, the Swiss National Bank unexpectedly raised its deposit rate to -0.25%, surprising investors and economists who had expected the interest rate to remain unchanged at -0.75%.

After the decision of the Swiss National Bank to raise its key rate by 50 basis points on Thursday, its head Thomas Jordan noted that the Swiss franc is no longer heavily overvalued due to the recent decline. The accompanying SNB statement also said that "tighter monetary policy aims to prevent inflation from spreading more widely in Switzerland." At the same time, the bank reserves the right to "intervene in the markets in order to stop the excessive strengthening or weakening of the Swiss franc."

The franc strengthened sharply after the publication on Thursday (at 07:30 GMT) of the SNB's decision on the interest rate, and the USD/CHF pair fell by 94 points, to a local 4-day low of 0.9783.

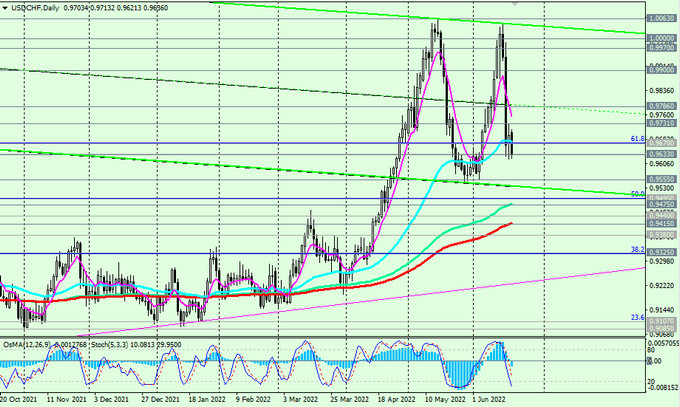

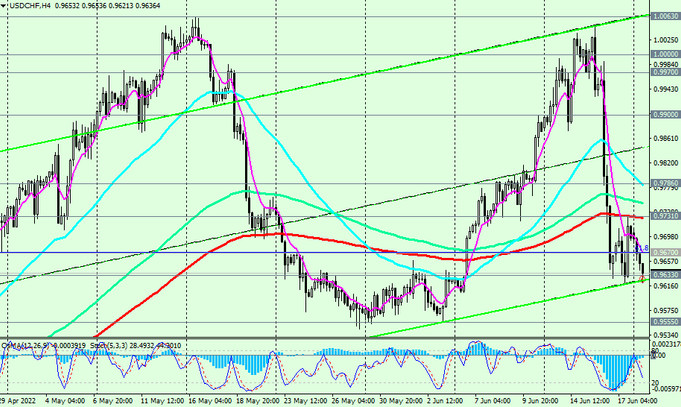

After a correction on Friday, USD/CHF is declining again today. At the time of publication of this article, USD/CHF is traded near the mark of 0.9633, having fallen from the intra-month high of 1.0049 and creating prerequisites for further decline towards the local support level 0.9555, the breakdown of which, in turn, will strengthen the negative dynamics of USD/CHF, sending it to the zone of key support levels 0.9435 (EMA200 on the weekly chart) and 0.9415 (EMA200 on the daily chart), which separate the long-term bullish trend of the pair from the bearish one.

The first signal to resume long positions will be a breakdown of the important resistance level 0.9731 (EMA200 on the 4-hour chart), which will open the way for USD/CHF to return to the uptrend.

Support levels: 0.9630, 0.9555, 0.9500, 0.9495, 0.9475, 0.9435, 0.9415, 0.9380, 0.9325

Resistance levels: 0.9670, 0.9731, 0.9800, 0.9820, 0.9900, 0.9970, 1.0000, 1.0060

Trading recommendations

Sell Stop 0.9615. Stop Loss 0.9715. Take-Profit 0.9555, 0.9500, 0.9495, 0.9475, 0.9435, 0.9415, 0.9380, 0.9325

Buy Stop 0.9715. Stop Loss 0.9615. Take-Profit 0.9731, 0.9800, 0.9820, 0.9900, 0.9970, 1.0000, 1.0060