Despite some decline, the DXY dollar index remains positive, while DXY futures remain above 104.00 mark at the start of today's European trading session. It should be noted that in the range of 103.50 – 104.50 DXY remains for the 5th day in a row, while market participants continue to assess the success of the Fed’s actions on the front of the fight against high inflation in the US, and despite the aggressive tightening of the Fed’s monetary policy, it continues accelerate.

According to the report of the Bureau of Economic Analysis, published on June 10, the consumer price index CPI rose in May by another +1.0% (+8.6% in annual terms), reaching a new 40-year high, which turned out to be higher than the forecast and the previous values. Core inflation, which excludes food and fuel prices, slowed to 6.0% from 6.2%, but was still above the forecast of 5.9%. According to revised data from the Bureau of Economic Analysis, company profits in the 1st quarter fell by 2.3% after rising by 0.7% in the previous three months, which was the first drop in five quarters.

Now, after the release of a series of weaker important macro data, market participants are beginning to re-evaluate the plans of the Fed and the prospects for its monetary policy, but the demand for the safe dollar remains at a high level.

Speaking before the House Financial Services Committee on Thursday, Fed Chairman Powell reaffirmed that "an unreserved commitment" to fighting inflation and trying to "moderate demand so inflation can come down" remains a top priority for US central bank officials. "The Fed could continue aggressive tightening even if economic activity slows sharply," Powell also said, while Fed spokeswoman Michelle Bowman said yesterday that another 75b.p. rate hike is on the way in July and at least 50 b.p. at the next few meetings would be appropriate.

The prospect of further tightening of the Fed's monetary policy creates prerequisites for further strengthening of the dollar and the fall of the US stock market.

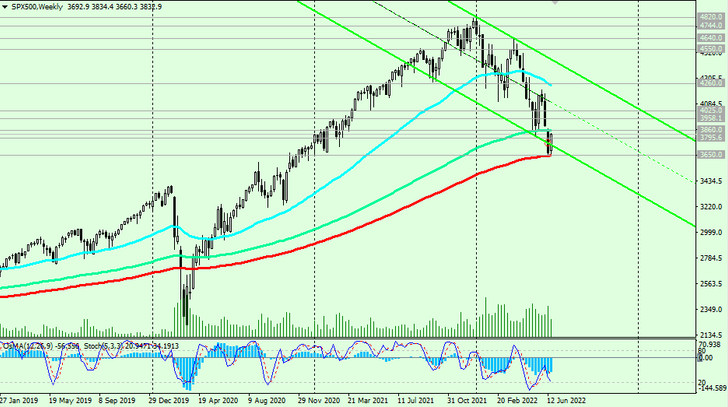

Thus, last week the US broad market index S&P 500 reached the local support level 3650.0, having fallen from the 4820.0 mark, reached at the very beginning of this year.

Despite the current upward correction, the negative dynamics of the S&P 500 and the entire American, and not only the American, stock market remains. Investors exit the stock market assets, preferring the safe dollar.

Fears are growing in the market that the rapid tightening of monetary policy by the Fed and other major world central banks, which so far cannot stop accelerating inflation, will lead to recession and stagflation (this is when economic growth slows down or stops altogether, while inflation continues to grow) in the global economy. These fears, in turn, also lead to increased demand for the safe dollar.