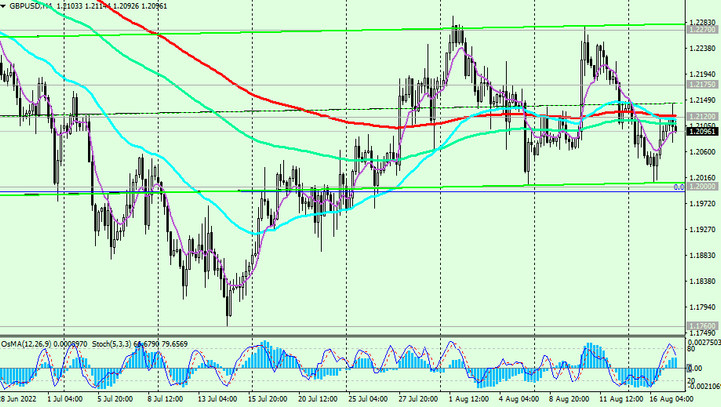

In general, there is a downward trend in the pair, taking into account also the renewed growth of the dollar.

Considering also the average volatility of the GBP/USD pair of 100-150 points, a breakdown of the “round” support level 1.2000 is “not far off”.

Below the key resistance levels 1.2570, 1.2740 GBP/USD remains in the long-term bear market zone. After the breakdown of the support level 1.2000, the next target will be the local support level 1.1760, and then the 1.1410 mark (March 2020 low and the lower limit of the descending channel on the weekly chart).

In an alternative scenario, and after the breakdown of the resistance levels 1.2175, 1.2270 (local high), GBP/USD will head towards the resistance levels 1.2570, 1.2600. The breakdown of the resistance level 1.2740 will be the first serious signal that the pair will return to the long-term bull market zone.

Short positions are preferred so far.

Support levels: 1.2000, 1.1900, 1.1800, 1.1760, 1.1410

Resistance levels: 1.2120, 1.2175, 1.2270, 1.2570, 1.2740, 1.2800

Trading recommendations

Sell Stop 1.2070. Stop Loss 1.2150. Take-Profit 1.2000, 1.1900, 1.1800, 1.1760, 1.1410

Buy Stop 1.2150. Stop Loss 1.2070. Take-Profit 1.2175, 1.2270, 1.2570, 1.2740, 1.2800