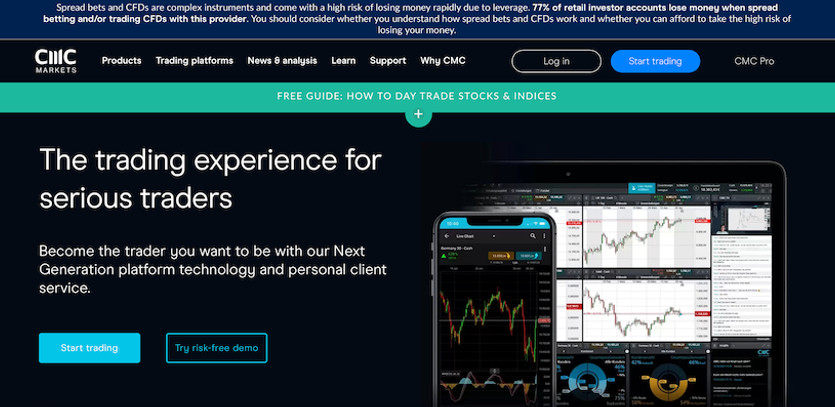

CMC Markets: A Snapshot

Established in 1989, CMC Markets is a renowned global player in CFD and stockbroking sectors. With over three decades of experience, this London Stock Exchange-listed company extends its top-tier trading services to Australian investors. Operating under a regulatory license issued by the Australian Securities and Investments Commission (ASIC), CMC Markets provides access to an impressive selection of over 9,500 financial instruments encompassing forex pairs, commodities, indices, shares, ETFs, treasuries, and cryptocurrencies.

Australian traders can access stocks and a myriad of tradeable assets from global markets including Canada, the US, the UK, and Japan. CMC Markets complements its offering with advanced trading support, including insightful research from Morningstar and a suite of tools aimed at empowering users to succeed in the dynamic world of global finance.

Approachable and Secure Trading with CMC Markets

CMC Markets is known for its user-friendly interface that facilitates easy navigation for both seasoned traders and beginners. There's no minimum deposit or withdrawal required to trade on its platform, which simplifies the initiation process for novice traders. Further bolstering its user confidence, all client funds are kept in segregated accounts. This measure is in addition to full insurance provided by CMC Markets for all accounts, ensuring the highest level of security.

Understanding CMC Markets: Pros & Cons

Every trading platform has its strengths and weaknesses, and CMC Markets is no exception. It brings an abundance of benefits, including a vast array of assets, multiple state-of-the-art trading platforms, high-quality research materials and live news feeds, attractive rebates for high-volume traders, and a no minimum deposit policy. On the downside, its fee structure can be intricate and potentially confusing, and the limited number of funding methods may not cater to every trader's needs.

Who Should Consider CMC Markets?

CMC Markets is an ideal choice for seasoned traders looking to access a diverse range of tradeable assets through its market-making approach. Moreover, it's an excellent starting point for beginners seeking to build their investment knowledge. The absence of a minimum deposit requirement to join the platform, combined with the comprehensive research resources and educational materials, allows new traders to learn the intricacies of investing without needing to look elsewhere.

Outstanding Features of CMC Markets

Among the striking features of CMC Markets is its stellar trading support that includes an extensive range of research materials and a comprehensive knowledge base. These resources aim to bolster traders' skills and decision-making abilities. The company prioritizes customer service, offering support 24/5 in multiple languages. An impressive array of over 9,500 tradable assets further sweetens the deal. Moreover, the lack of minimum deposit requirements ensures the platform is accessible to traders of all kinds.

Regulatory Compliance and Risk Management at CMC Markets

CMC Markets operates in strict accordance with the regulations laid down by ASIC. Beyond regulatory compliance, it offers advanced risk management features to its users, such as guaranteed stop-loss orders (GSLOs) for a premium, providing an extra layer of security.

Understanding CMC Markets' Pricing Structure

CMC Markets follows a competitive pricing schedule tailored to accommodate various trading preferences, account types, and asset classes. While its fee structure may be a bit complex, it offers some of the most affordable costs for Australian clients who trade frequently compared to other local brands.

Platform Options and Security Measures at CMC Markets

To cater to diverse trading needs, CMC Markets provides a variety of trading platform options to its users. These platforms are designed for reliability, enabling users to maximize their market opportunities. The platform also has robust security measures, which include two-step authentication for logins, encryption technology, and segregated funds.

How User-Friendly is CMC Markets?

One of the stand-out features of CMC Markets is its user-friendly interface, which is complemented by an array of research tools and educational resources. Moreover, its customer service team is known for its promptness and efficiency in resolving queries. The overall user experience provided by CMC Markets is truly second to none.

Wrapping Up

In conclusion, it’s clear why CMC Markets is a leading broker in the Australian market. With its broad asset variety, top-tier customer service, and excellent security measures, it caters to a wide range of investors. As a regulated entity in Australia, it provides a high degree of security for client funds and interests.