The DeMarker Oscillation Indicator is an often overlooked technical indicator, but it can provide information with high accuracy about the moment when the market is experiencing a change in the balance of power.

With a properly set DeMarker, trading professionals can exit and enter trading positions usually at least one candle earlier, allowing them to not only make higher profits but also reduce trading losses, giving them two bonuses in one unique indicator.

Strategy entry rules

Entering long positions

-DeMarker indicator line passes through the central boundary (0.5) from bottom to top

Entry into short positions

-The DeMarker indicator line passes through the central limit (0.5) from top to bottom

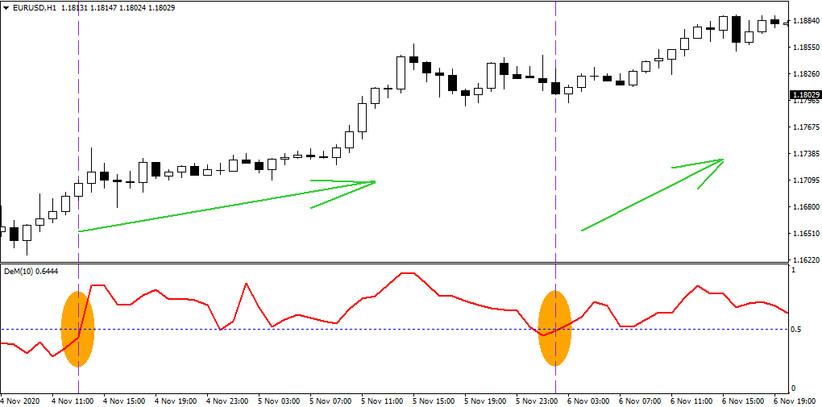

The chart below shows two examples in which a long entry signal was created (see Strategy Entry Rules above), after which the market began to rise as expected.

The chart below shows an example of two short trades, the start of which is marked by a purple vertical line and the reverse ends of the trades are represented by red vertical lines.

Trading with Central DeMarker allows you to achieve success rates from 50% to 80%. The final success rate is then influenced not only by the instrument traded, but also by the correct setting of the indicator and of course the time frame is also important, which can also have a significant impact on the whole strategy.