Millions of people from around the world trade in the FOREX market every day. These traders range from newbie amateurs to highly skilled professionals and corporate / bank traders. Millions of dollars in profits or losses are earned or lost every single day. Worldwide, hundreds of millions of transactions are made on daily basis.

But what is the basis of these trading decisions and what lead these trades to become successful or failure?

It is only logical to think that all or most (at least 99%) of these decisions are based upon some sort of systematic thinking rather than emotions or wild guesses.

Basically, forex traders and experts have developed various sorts of analytical tools over the years in order to make more informed decisions. While some of these tools are simple, others are complex. One of the easiest ways to understand FOREX analysis is to divide it into following two parts:

- fundamental analysis

- technical analysis

Remaining article will discuss the basics of forex fundamental analysis.

What is meant by fundamental analysis in FOREX?

Fundamental analysis is concerned about looking at the underlying value of the product. In stock market, it simply means to calculate the intrinsic value of a company. The same concept is used in the case of FOREX. Fundamental analysis aims at understanding the effect of economic conditions on the value of a currency. Along with economic conditions, social and political factors are also usually considered. The impact of all these forces is estimated in order to predict the future supply and demand of the currency and hence its value.

Economic conditions:

Various economic indicators, such as Gross Domestic Product (GDP), unemployment rate, interest rates, inflation, industrial production, Consumer Price Index (CPI), Producer Price Index (PPI), Employment Cost Index (ECI) or retail sales, are used to determine the economic condition of a country. Government agencies and private organizations release periodic reports about a wide range of economic indicators. These reports when studied in a suitable manner may provide a very clear picture about a country’s economic condition.

Some of these reports are general and simple to understand while others may be complex.

Not all but some of these reports are easily available to the general public, for example, reports regarding unemployment ratio. These reports are often created for a specific period of time, for example unemployment rate during the last fiscal year, and hence may serve its purpose within certain limitations.

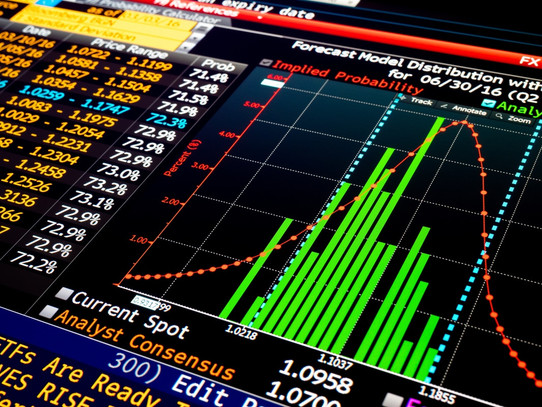

Reports related to economic conditions, depending upon its sensitiveness, can cause huge price and volume movements in the FOREX market. The planned economic indicators can be seen in the economic calendar . There you can usually see three values next to every economic indicator - previous value, consensus (expected result) and current (real result).

Generally, it is a rule of thumb that any significant difference from the consensus of the economic indicator will cause considerable price movement. The most commonly used economic measures are discussed below.

Gross Domestic Product (GDP):

Most people are aware about the basic concept behind GDP. It is usually considered to be the biggest economic measure of any country. For any individual country, GDP measures the market value of all products and services produced in the given year. When compared with the previous immediate figures, increase in the GDP figure indicates economic progress in the country and vice versa. Along with GDP itself, traders often rely heavily on two related reports; the preliminary report and the advance report.

Industrial production:

As the name suggests, industrial production report takes account of overall production of factories, utilities and mines in the country. This report also discusses the extent to which each industry utilized its capacity. In an ideal condition, a nation would want to see production equivalent or nearest to overall capacity. Better capacity utilization can be dependent on various factors, such as provision of electricity and gas to industries, skilled workers, stable political environment and technological advancements; each of which may be studied separately.

One of the ways traders can use industrial production indicator is to study and analyze utility production in the country. This industry is usually highly volatile and may directly impact the capacity utilization of most other industries; hence, considerably affecting the national currency value.

Unemployment rate and NFP report:

These two economic indicators are usually released together in the same time on the first Friday of each month.

Unemployment is simply a number of people who are actively searching for a job, but are unable to find the employment. Unemployment rate is created by dividing the unemployed people by the number of employed people. Unemployment rate is also called as jobless rate.

NFP report (also called as Non-Farm Payrolls, Employment Change, or Non-Farm Employment Change) is representing the change in the number of employed people month by month. People working for nonprofit organizations, farm workers, general government jobs and private household jobs are excluded.

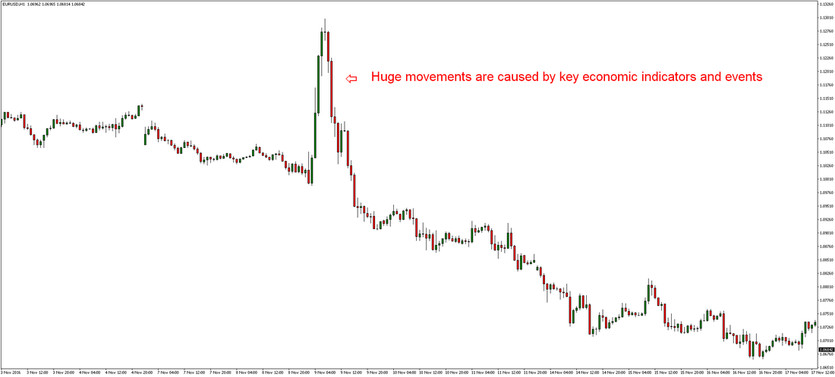

Unemployment rate and NFP report usually cause huge market movements as you can see in the chart below.

Consumer Price Index:

Consumer Price Index (CPI) measures the consumer goods' and services’ prices across various categories. One of the simplest forms of CPI is to compare prices of consumer goods with previous year prices and represent it in the form of overall percentage.

Consumer Price Index can be used in comparison with national exports report to analyze whether or not a country is making money on its consumer goods, products and services. However, it may not be a straightforward analysis as the value of exports is often dependent upon the strength or weakness of the currency.

Interest Rates:

Analysis of movement in interest rates is also a very useful way of looking at the fundamental analysis. In some cases, knowledge of interest rates movement may alone be enough to predict future price movements in currencies.

Actually, there is a clear relationship between interest rate movements and currency prices. Consider a simple example in order to understand this phenomenon.

Suppose you are a British citizen. Suddenly, interest rates in the United States have increased massively. Higher interest rates mean better incentive for investors to invest their capital. Ideally, you would now want to invest in the US in order to earn better return. As more and more people are looking to invest in the US currency, the price of that currency increases. Simple “demand and supply” rule of economics holds true here.

Political conditions:

In most cases, unusual political events have direct consequences on the FOREX market. If you read or watch business news, you would observe reports mentioning political events which led to increase or decrease in the value of any particular currency.

A brilliant example of this effect is that of 2016 BREXIT referendum poll in the United Kingdom. As UK citizens chose to leave the European Union block, investors predicted adverse economic conditions of UK in the near future. As a direct result, the value of Great Britain Pound (GBP) dropped massively against the United States Dollar (USD) and Euro.

Similarly, wars, marshal coups or terrorism can negatively impact the value of national currency.

Conclusion:

While someone says that fundamental analysis is a reliable way how to trade forex market, someone other says that any economic indicator and its result is already counted in the current market price, and therefore - the economic indicators are lagging.

Remember, there is no wrong or correct way how to trade forex. There are only profitable or lossy results.

But the fact is, that the economic indicators as well as any unexpected events cause huge market movements (significantly increased volatility). Therefore, it is important to watch forex economic calendar regularly and adapt your trading strategy to current market conditions. This is the only key to a long-term successful forex trading.