The news is one of the most important factors you need to pay attention to when it comes to trading the Forex market.

Specifically, Forex News Trading refers to taking trades immediately after the release of certain news reports, usually economic data that can impact a single currency and therefore its exchange rate against other currencies.

Before getting yourself involved with news trading strategies, you must take into account and remember that news trading is generally considered a high-risk trading activity. This is due to the high volatility that more often than not occurs when an important news event is released.

Big market players such as financial institutions open and close their positions in response to the news event generating large price swings in the market as a result.

We can say that they are like the whale in the ocean causing large waves on which smaller fish can ride.

Demo-trading any news trading strategy until you are confident enough that you have fully understood is absolutely recommended before trading it live. Also it is very important to note that especially during news trading there can be huge differences in execution of your orders between demo and real accounts.

The Economic News and Forex

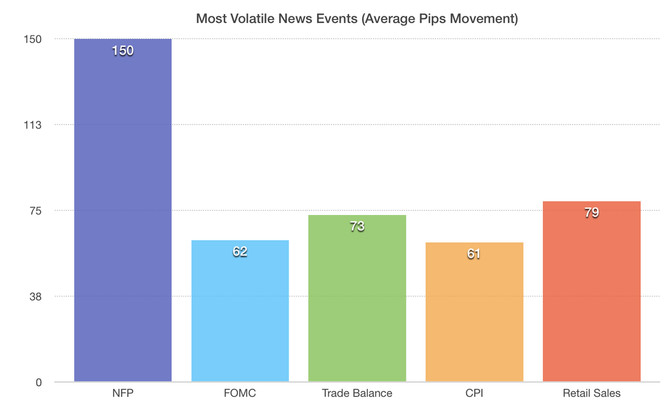

The first important thing to realize is that not every news event is important enough to cause big price changes in the market, hence not every news event is good enough for trading.

In this regard, it’s important to differentiate between “ordinary” news and major, market-moving news. Generally, major news will be the more important economic data releases for the economy like GDP, unemployment, CPI, retail sales, trade balance, current account and so on. And even out of those reports, only certain components can be important enough to actually move the price in the Forex market.

Understanding these news reports and how the market reacts to them takes time and practice.

Some reports will be more important at one point in time, and at other times, different economic data will be more important. So, for example, if inflation is a concern for investors at the moment, then the CPI report will have a much bigger impact on the market than for example the GDP report. Likewise, if unemployment is of greater concern to the economy and investors, then it will have a bigger impact on the price than inflation news like the CPI.

Most of the news releases that affect the Forex market come from the US. Additionally, US News will tend to have a bigger impact on the market than news from other countries. This is largely due to the fact that 85% of Forex transactions involve the US Dollar and also for the fact that the US is the largest economy in the world. News from the United States often will not only affect USD pairs but can also sometimes affect cross currency pairs not involving the US Dollar, usually because of changes in the risk sentiment.

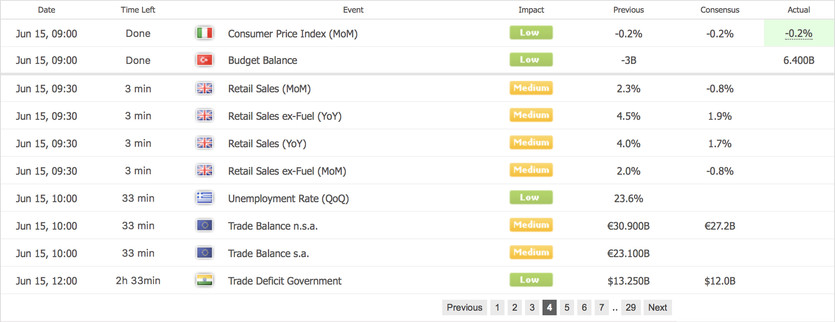

Online economic calendars are a great trading tool that provide a list of the most important news events for the week. Many times these are grouped into 3 types: low impact, medium impact, and high impact news events.

So, just by looking at the calendar the trader can take note of the most important news events he should be aware of and accordingly protect his account and take any appropriate trades at the time when the news is released.

Straddle Trade

The straddle strategy is about trading highly volatile news events in either direction by placing two pending orders before the news is released.

The straddle strategy is simple:

- Check the charts 20 minutes before the release of the news and take note of the highest and the lowest prices during this 20 minute period. These two levels define the trading range for the straddle trade for the upcoming news event.

- Place two pending orders: one buy order above the high of the range and one sell order below the low of the range.

This strategy covers both outcomes of the news event. Regardless of whether the news is good or bad, the straddle strategy ensures that you are in the market and ride on any subsequent moves in the price.

The Stop-Loss is placed at the other end of the range. So for example for a long trade, the Stop-Loss is the lower end of the range while the entry is slightly higher than the high of the range.

Of course, there are risks involved with this strategy, and mainly they come from a confused market that goes up and down and triggers both of your orders in the process, thus leaving you with a hedged - net neutral position, but potentially, losses in the end.

Like all other trading strategies, practicing and mastering the straddle is a must before taking it to your live trading account. Of course, various other trading strategies can be also built for trading news events.

The Forex Broker for News Trading

Picking the right broker for news trading is extremely important. Because news trading involves a lot of transactions over shorter periods of time and generally pocketing on small profits, trading conditions from your broker have a huge impact on news trading strategies.

Mainly, a stable platform, fast and precise order execution, as well as tight spreads, are among the top things to look for in a broker that you intend to use for news trading.

For more information about forex brokers, do not miss our Truth about Forex Brokers.