This trade idea was first sent to subscribers of the Free Profitable Forex Newsletter on July 22 2022.

Last month, we discussed the situation on EURJPY and the potential for short trades there. Also, while the USDJPY setup we sent two weeks ago didn’t progress as anticipated, USDJPY is reversing down hard this week, forming a bearish reversal signal on the weekly chart.

The reason for the JPY’s reversal is the fall in global bond yields as recession fears grow further. This morning’s Eurozone PMI reports were much worse than forecasts, as were yesterday’s releases from the US (Unemployment claims and Philly Fed manufacturing index). The global economy is slowing and heading for a recession, and the markets have taken note. Falling bond yields are a clear indication of that.

So, it seems it’s time to go long on the Japanese yen (JPY), and there is no better currency to short against the yen than the euro. Hence, we have a short EURJPY trade recommendation for this edition of the Fx Trading Revolution newsletter.

EURJPY ready to fall hard?

We discussed at length the fundamental reasons why EURJPY is likely to turn down in the link shared above. It seems the scenario is slowly transparent in that direction. The ECB hiked interest rates by 50bp yesterday, but all of EUR’s gains were reversed. And there is a good reason for that. Recession is coming in the Eurozone.

The PMIs released today, which are a leading indicator of the economy, were almost all below the 50.00 reading across the Eurozone. Readings below 50.00 indicate that a recession is coming in that sector. Manufacturing was at 49.6 and services at 50.6 (very close to recession). The fact that the euro can’t hold onto the gains makes perfect sense because the ECB won’t be able to keep hiking rates if the economy is entering a recession. Fx traders are anticipating this and are thus shorting any rally in EURUSD.

The US economy is in better shape, and markets reflect this by pushing the dollar higher. But the US economy is also slowing as no one functions in isolation. So, overall, most economies around the world are slowing fast, and some are headed for a deep recession (like European countries).

There is one currency that benefits the most when recession fears hit markets. And that is the Japanese yen. With EURUSD looking vulnerable to further losses below parity (0.98 is realistically possible) and USDJPY looking like it has peaked, EURJPY could easily side toward the 135.00 area in the coming weeks.

Bearish EURJPY Trade Plan:

The 4H EURJPY chart shows us the pair was rejected several times at the 144.00 zone in June. It is a gradual move down since then, and a bearish channel has formed. The bullish reaction to the ECB rate hike yesterday was sharply reversed around the 142.00 level, and EURJPY is now trading below 140.00. This could be the start of a larger leg down that takes out the 137.00 lows from earlier this month.

EURJPY is now reacting with some moderate support in the 139.00 zone at the prior lows/highs there, so some rebound is possible at this stage. Given it’s Friday afternoon and the end of the trading week, some profit-taking may also cause such a reaction. Therefore, it makes sense to look for potential entries starting from Monday next week.

A potential rebound in EURJPY will also take us closer to the resistance line of the channel. It is a preferable scenario that we enter the trade closer to the resistance. This reduces our risk (distance to stop loss) and increases the distance to the TP target zone. Thus, if a rebound comes from here and takes us back toward the 140.00 zone or higher to the resistance line, it would be an excellent opportunity to consider a short trade.

The initial target area for this trade can be 135.00, which is where the channel lower support line currently stands. In a more extreme bearish scenario, EURJPY could also reach the 130.00 area or lower.

Entry:

Stop loss:

Targets:

- 1st - 135.00 area

- 2nd - 132.00-133.00

Trade signals from the past weeks

- July 1, 2022 - Short NZDUSD from 0.6175, closed at breakeven (July 18) as trade didn’t progress as anticipated = 0 pips

- July 15, 2022 - Long USDCAD from 1.3050, exited at 1.30 (July 18) = -50 pips

TOTAL P/L in the past week: -50 pips

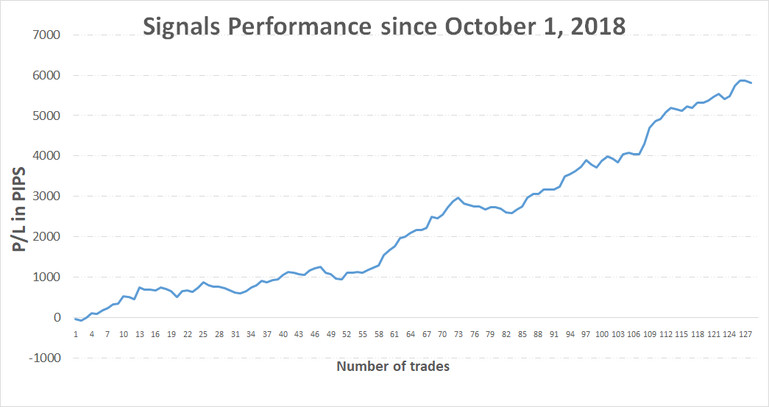

TOTAL: +5805 pips profit since October 1, 2018

![Looking to Short EURJPY next week [Fx Newsletter, Jul 22]](https://cdn.investworld.net/insecure/w:835/h:407/rt:fit/g:ce:0:0/el:1/f:jpg/c:0:0/q:90/czM6Ly9zZXJ2aWNlcy0tODM1OS0taW1hZ2VzL2EzYWJjYTI4NWMyMWQ2YTMyZWRmNjJiOTE0YjRhM2EzNWY5ZTlhNjIucG5n.jpg)