A common question in the Forex community, especially asked around a lot by rookie traders, is whether fundamental analysis or technical analysis is better to trade the Fx market.

The truth is hidden somewhere in between. There is no right answer to that question and no one has been able to give a precise and accurate answer as that comes down to subjectivity and preferences. Both technical analysis and fundamental analysis have unique advantages and disadvantages, but, there are several reasons why technical analysis is still king for trading despite the fact that fundamentals often override technicals when it comes to causing the price to move.

Making sense of fundamentals can be time-consuming and challenging

As traders, we don’t care whether a currency pair is moving up or down. All we need is for it to move in order for us to make money.

Aside from the fact that fundamental analysis is definitely more time-consuming than technical analysis, there is the additional complication that fundamentals can often be hard to digest and understand. Bear in mind, we are talking about experts here, not average everyday Forex traders.

Just turn on a financial TV channel or grab a financial newspaper and you will see the degree of disagreement that exists between the expert economists. One says EURUSD will go up and another one is arguing that it should be trading much lower.

In these kinds of situations, it can be difficult to make a decision as a trader if you intend to trade on fundamentals alone.

There is wide agreement regarding the important technical levels on the charts

The big advantage of technical analysis over fundamental analysis in this regard is that everyone is looking at the same thing and it’s easy for everyone to agree on the important technical junctures on the charts. Technical traders believe that the price never lies and they don’t care why the price has moved. They only see that it moved and based on that they can analyze how it fits within the larger context and make a decision.

Chart patterns and other technical signals are only a product and a reflection of the mass psychology of the market participants. And the truth is, that ultimately, the psychology and the opinions of traders and investors moves the price rather than the fundamentals themselves. So, to separate technicals and fundamentals completely would not be right and appropriate when you take this into consideration.

A strong reversal on the charts is most often an indication of the true face of the market being revealed after which a big move in the opposite direction follows. When technical traders see a reversal pattern they can easily decide whether to take the trade or not, but the fundamental trader may need some time to digest the news before he can make up his mind.

Fundamental peculiarities - Sometimes bad news can cause a currency to rise

Take, for example, a trading day in which an important event on the calendar takes place, let’s say a central bank meeting or some pivotal economic data is being released. Usually, in such events there are two main outcomes, if the report is strong it would be bullish for the currency and if it’s weak it would be bearish for the currency.

Well, believe it or not, there are days when good reports cause a currency to fall and there are days when negative events cause the currency to strengthen – leaving many fundamental traders and so-called “experts” scratching their heads and being unable to explain what the heck is going on in the market.

If the experts have a hard time understanding what’s going on, how should a regular Forex trader with no economic background be able to get that?

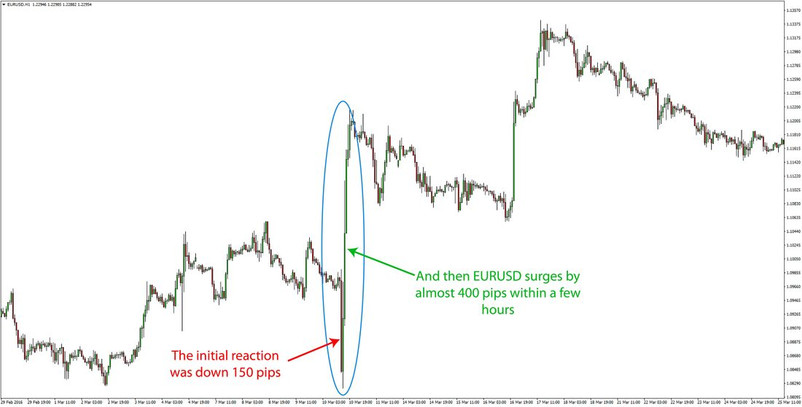

Consider this example from March 10th 2016, illustrating this point. The ECB boosted QE and cut rates on the day, delivering an overwhelmingly dovish message on the meeting, yet the Euro soared anyway. In these kinds of situations, it can be difficult to wrap your head around the fundamentals, but the patterns on the charts are as clear as day.

An example from 2016 when a super-dovish ECB wasn't good enough to weaken the Euro

This is why technical analysis is so popular and indeed useful for trading the markets. It’s much simpler and at the end of the day, much more practical and effective for making a trading decision than fundamentals.

A fundamental analyst or trader can rarely give you a precise price level that would indicate his view of the market is wrong but, that is never the case with technical analysts. Those who trade based on technical analysis always have a price that tells them they are wrong.

Find a balance between fundamental and technical analysis

This article in no way suggests you should ignore fundamentals, but it does suggest that being too obsessed with understanding the fundamentals can lead you down the wrong path as a trader.

Fundamentals may often trump the technical levels, but also, technicals can often point in the right direction way before the fundamentals become evident. Technical analysis very often provides the much-needed clarity to make sense of the aftermath of a fundamental event.

Finding the right combination of technicals and fundamentals is an approach that works well for a lot of successful Forex traders. The bottom line is that both are important and are better to not be ignored or you are likely to feel sorry for doing so later.