Forex traders and investors are paying attention carefully to the different world events that could affect the foreign exchange market. One of these events that started in July 2018 is the trade war between the US and China.

To understand how this and other similar events affect the Forex market, it is essential to know about the impact that import tariffs have on currency exchange rates.

Import Tariff

An import tariff is a tax or charge between two different countries that have trading businesses. It allows the growth of a country’s economy, fostering the local production and investing in the national market.

Although some economists are against the tariff, talking about the negative impact it has on the economy, others claim that the rise of the currency exchange interest rates negates the effect of the tariff.

That way, both the importer country and the exporter country neither win nor lose more money than what they already invested.

Effect of import tariff on Forex

Whenever a country decides to apply or raise the import tariff of another country, it forces the reduction of demand for the other country’s products.

Because of this action, the importer country receives less foreign currency. It affects the economy of the second country, reducing the amount of foreign currency they own. The currency of the latter country then weakens, which is reflected in the Forex market.

This activity can be seen in different world events through the years. The most recent development is the Trade War between China and the US.

The US-China Trade War

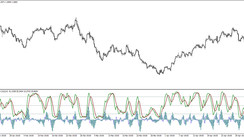

Recent communication exchanges between the government of China and the US are proof of how the Forex exchange is affected by the import tariffs. Taxes between these two countries are of the highest ever seen, and both currencies (the Yuan and the USD) suffered in different instances against other currencies in the Forex market.

However, the USD has the status of a world’s reserve currency and is the most frequently used currency around the globe to make trades, even between countries that don’t have USD s their main currency.

The Yuan (USDCNY) lost almost 8% of its value. Still, the USD remained an outperformer, as traders and investors, noticing the imminent changes that the trade war could bring to the global economy, starting investing in the safest currency, which is the USD.

The reason for this difference between both countries is that at least a quarter of the total of China’s imports comes from the US, while the US doesn’t need to make as many imports from China.

Nevertheless, the continuous changes that each government has made in response to the other country’s actions are keeping the numbers on the forex market unstable and volatile. It is something that traders in Forex must follow to know where to invest.