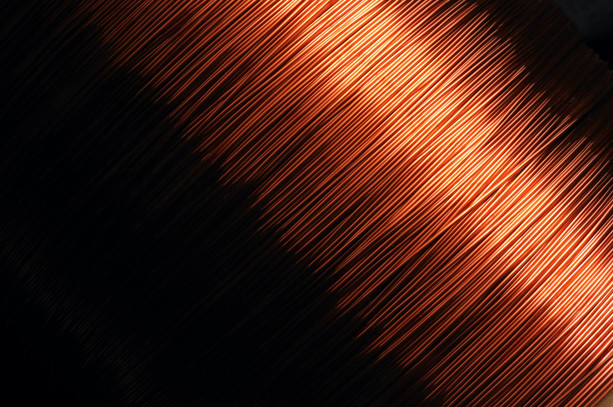

Copper is one of the best known and used metals in the world. Some countries still use this metal in their currency. However, its most common use in the modern world relates to industrial applications of all kinds. After all, copper is one of the best and cheapest electric conductors.

Now, trading copper is a favourite among operators in the sector. That is because the prices of this raw material are subject to a healthy amount of volatility in the short term. Although, like its more expensive counterpart (gold and silver), copper is very stable in the long run. One could even argue that the current price of copper is linked to the United States dollar.

In this article, we will give you the necessary strategies that you should know for trading copper.

How does copper trading work?

People mainly invest in copper because of its accessibility. There are different methods, but the most common way to get into the copper market is through a copper ETF (exchange-traded fund). The downside is the ETFs tend to come with expensive commissions, making it cumbersome for starting traders.

A much cheaper and more affordable method for everyone is to trade CFDs (contract for difference) on copper. Trading CFDs online from home allows you to make a profit based on your copper price forecasts, opening or closing positions. The risk is also fairly low and the learning curve is not too complex.

Techniques to keep in mind for trading copper

Trending market

Knowing market conditions and trends are a prime point for trading. A professional trader will adjust their strategy to any current market condition. That means having a strategy characterized by having a range of prices in which to trade at all times. A good way to use the trending market strategy is incorporating the use of oscillators or trend lines to look for buy and sell signals.

Consolidating market

A consolidating market is going to need a different strategy at the time of trading copper. A consolidating market is identified as a market to which limits are currently incorporated. In a consolidating market, the trader is seeking to sell copper at a resistance level or buy copper at a support level. So, the trader could look to exit the market at the other end of the range.

To sum up, market consolidation will eventually break out of its range, so traders need to manage their risk using invalidation levels.

Emerging markets

The countries that are developing quickly are the main ones involved in the copper business. The reason for this is that they want to improve their infrastructure as their economy grows. Therefore, emerging markets such as China, India, and Brazil have a growing share of global copper demand.

That means getting into the markets indicators led by these countries. It’s a fairly risky business. But it’s bound to yield large returns in the long-run.

Tips for Beginner and Advanced Copper Traders

- Traders must first identify the current condition of the market and then apply the strategy that suits them best.

- Every trader, both beginner and advanced, should be aware that demand from emerging markets could drive the price of copper in the long term.

- Copper is priced in US dollars, so operators should be aware of every move in the US dollar in relation to their home currency.