Currency valuations may be controlled when central banks either sell or purchase bonds or the local currency on the foreign exchange market. The reason for this is so that the market can move in a direction that is not favorable to the central bank and its country that much. The goal of a central bank interventions is usually to support an export of a given country.

The lower the local currency is valued at, the better it is for exports and for the economic growth of that country.

This is because the lower a currency is valued, the less of that currency it takes for a foreign country to purchase the local country’s goods or services. On the other side, high value of a currency usually discourages foreign customers and investors.

Types of Currency Interventions

Currency interventions are usually classified into two main types – sterilized and non-sterilized transactions.

With sterilized transactions, the central bank usually simultaneously buys and sells foreign currency denominated bonds as well as local currency bonds in order to offset the amount in their favor.

In the case of non-sterilized transactions, there is no simultaneous buying and selling of domestic currency bonds. Only foreign currency bonds and the domestic currency are bought or sold, without the offsetting transaction. Central banks may also purchase and sell the local currency directly on the spot or forward markets in order to influence the value of the local currency in the short term.

Jawboning and Concerted Interventions

Some central banks practice “jawboning” as a currency intervention method. This involves threatening to intervene in the market by buying or selling currency or explicitly stating that the currency is either undervalued or overvalued. The process does not involve the actual purchase or sale of currency but can result in the same effect as if a currency was actually traded. Jawboning is done through central bank meetings and speeches of central bankers. It tends to be more effective for regions where there are more frequent foreign currency interventions.

In the case of concerted interventions, several countries or regions join forces in influencing the movement of a particular currency. This may involve jawboning as well as operational intervention.

The Bank of Japan is noted for the huge currency interventions which were made between 2000 and 2003 when more than $61 billion was spent to stem the appreciation of the Japanese yen. This was done so that the Japanese economy would not suffer based on exports becoming more expensive for purchase by foreigners. This intervention was a successful one.

However, not every intervention has to be successful. Probably the most famous unsuccessful intervention was performed by the Bank of England in 1992. And the man known for breaking the Bank of England is called George Soros, making a huge £1 to £1.5 billion gain in total. He did it by selling $10 billion of GBP. You can read more about George Soros in the article called " The Best and Most Successful Forex Traders ".

How Central Bank Intervention Affects Forex Traders

During periods of currency interventions, the markets may not move as expected based on technical and fundamental analysis. Therefore, traders need to be extra careful when trading during these times as the risks of placing losing trades may increase significantly depending on the magnitude of the currency intervention.

The greater the intervention in terms of currency value, the riskier trading becomes for retail traders. It is advisable not to trade against the central bank’s position and to keep tighter stop losses. Also, it is advisable to use take profits in order to lock in any profits which may be garnered.

However, it is also important to note that the interventions (and especially their end) usually lead to the lack of market liquidity and can cause huge slippages when executing your orders. Due to this fact, it is usually better to completely avoid trading currencies that are under an intervention and wait until the intervention ends.

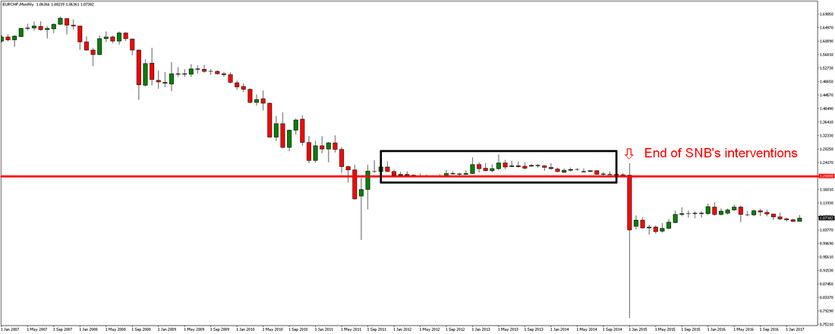

In the chart below, you can see the famous Swiss National Bank's interventions performed every time EURCHF reached the 1.2000 price level. And then you can see a huge selloff after the SNB unexpectedly ended the interventions.

For retail traders, it is also useful to note that after an intervention, the markets tend to return to the direction in which it was originally moving before the intervention took place.

For traders who want to benefit from currency interventions, it is also important to note that interventions usually take place at the levels of previous interventions (like in the case of EURCHF and the 1.2 price level).

However, this is not necessarily the case as the central bank may choose not to intervene for whatever reason. Also, any talks of threats of currency intervention may be a signal that an intervention is likely to occur in the near future. Analysts may also mention impending central bank interventions so traders should keep their ears open for any such announcements.

Conclusion

Central banks may intervene and influence the value of their local currency by purchasing or selling that currency on the forex markets. Usually the aim of intervention is to keep exports competitive and to foster economic growth.

The lower the local currency is valued, the better it is for exports and economic growth. Intervention may be sterilized or non-sterilized depending on whether the monetary base is changed or not.

Jawboning is a form of intervention that involves threats of intervention but no actual buying or selling of foreign exchange reserves. Concerted intervention is when several central banks works together to affect a particular currency.

Retail traders may benefit from currency interventions if they trade in the same direction as the central bank. It is best to place tight stop losses and to lock in any profits with take profits, but there is a risk of low liquidity when these orders should be executed. Bear in mind also that the forex markets tend to return to their original directions after central bank intervention ends.