1) Signal Sellers

Signal sellers are commercial firms, pooled asset managers, managed account companies or individual traders that express their ability to have a constant edge on the market. To be precise, they claim to identify the best time to open or close a position based on expert guidance.

The idea is that following buying those tips are guaranteed constant success. The only thing traders have to do is pay a preset amount in exchange for a set number of signals.

If this sounds too good to be true, it is because it might be. Even though there are signal sellers who are sharing their knowledge and experience as long-time traders, the vast majority is just looking for cash.

Some scammers will collect money from unseasoned traders before disappearing. Others will intermittently recommend some good trades, to keep perpetuating the signal money. All and all, it is best to avoid anyone who claims to have a 100% track record when it comes to market signaling.

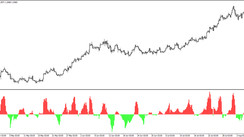

2) Robot Scamming

These scammers promote their software's ability to make automatic trades that are guaranteed to turn massive profits. The problem lies in the fact that many of these systems have not passed a peered review or get tested by an independent source.

The best way to know the veracity of their claims is by looking at their optimization codes and trading system's parameters. If they aren't available or if they look invalid, run away.

3) Dishonest Brokers

Bad actors exist everywhere. So when it comes to dealing with a forex broker, always make sure to check the firm's credentials. The first step is looking for their FINRA number as well as their SEC registration number. Both institutions are highly respected. So scammers will never dare to be regulated by either institution because that would mean severe financial and legal consequences on top of losing their trading license.

4) Phoney Forex Investment Management Funds

In the last years, forex management funds have increased. Sadly, most of these are scams. They offer investors the chances to have their forex trades carried out by highly-skilled forex traders for a modest price.

The main issue is that some of these forex managers ask for full control of their entire finances. Thus, while traders watch their share of the pie go up and down, these scamming fund managers look for the best moment to run away with all the pooled funds.

The first rule of here, don't give up control. Always make sure you can leave whenever you want. The second rule, if a funds sound too good to be true, they are scammers. Average Forex Funds will have a growth similar to the index. Anything that promotes to beat the market by 800% in 6 months is fake.

5) "Long-Term" Forex Investments

If you can't withdraw your money at your leisure or after a small interval, run. All forms of investments allow its users to withdraw their money at an acceptable timeframe. That's true for hedge funds as we well as 401K. So when that option isn't available, then it's time to walk away.