Talking about trading systems, Larry Williams’ OOPS system still remains to be one of the most popular trading systems today. Larry presented his short term trading methodology in his famous book “How I Made One Million Dollars Trading Commodities”.

Today, a lot of different variations of this system are used worldwide by professional traders.

The OOPS pattern, as discussed by Larry Williams, is observed when:

The theory behind this pattern is very simple and logical. Larry believes that non-professional traders check common charts at night and enter their orders for the upcoming day.

On the other hand, professional traders wait for the trend to be actually developed in the day and place their orders accordingly at the daytime.

Hence, if the market opens considerably lower or higher than yesterday's range, it is an indication of the panic of non-professional traders. This provides a great opportunity to professional traders to use the non-professionals’ emotions against them by placing a contrarian trade and earn profits.

Basically, it is a gap trading strategy which means that it is based on fading the direction of the opening gap.

What happens is that non-professional traders usually overreact to some important news even before the market opens and create the gap when the market opens (especially in case of stocks, commodities or stock indices). This gap is the result of the opinion of the average crowd.

Soon, these traders notice that they overreacted in response to the initial event or news. At this point, the traders realize their mistake and reevaluate their position. This causes prices to reverse and a movement in the opposite direction occurs.

This trading system provides a lot of valuable information related to buying and selling in the FOREX market, even though gaps occur rarely since it’s a 24-hour market. However, weekend gaps at the open are quite common in the FOREX market, so the OOPS trading system will work best on daily and weekly charts.

The OOPS buy strategy is explained in the following points:

Similarly, the OOPS sell is generated according to the following pattern:

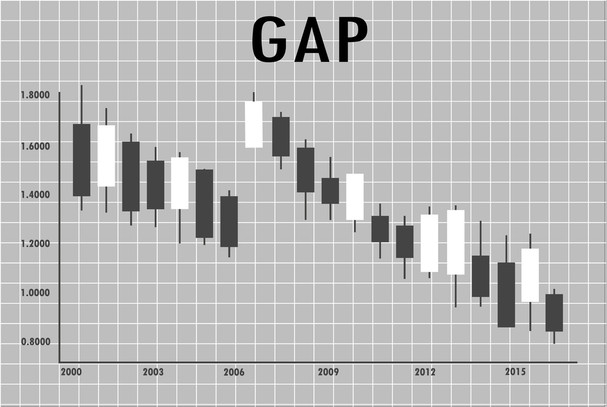

USDJPY Daily timeframe - An example of Larry Williams’ OOPS sell

The Larry Williams OOPS pattern has been used by numerous investors and traders and it is known to have a high level of accuracy and validity. It provides an opportunity to get valuable profits from fading the gaps.

However, it is still very important to remember that it is not a purely mechanical concept and it is possible for variations to occur in this system. Also a proper exit strategy should be defined as well.

Therefore, the best way to get started with the OOPS pattern is to use trial and error method. It is you who will have to figure out the best application of the OOPS system in different trading conditions and across different markets.