This trade idea was first sent to subscribers of the Free Profitable Forex Newsletter on November 11, 2022.

It’s another one of those wild rides in the markets this week. First, the news of the crypto exchange FTX going bankrupt triggered massive selling in major cryptocurrencies (Bitcoin down to 15,500); then yesterday, the US CPI report injected further volatility (albeit in reversed direction) as it showed inflation slowed much more than the forecasts. The markets took the CPI report as good news (actual 7.7% vs 7.9% forecast), unleashing a massive risk-on rally and a big plunge in the US dollar.

With the volatility now significantly higher than before and the events that triggered it being so recent, it’s tricky to assess where markets may move in the very near term. So, with this in mind, it seems best to stay out of the market, which is why we are not issuing a specific trade idea in this week’s newsletter.

This is not likely to be a USD reversal

A lot of discussion has started this week about whether the dollar has finally peaked and will turn lower from here. While there can be many arguments for why it has or hasn’t peaked, a much easier and clear question is if a dollar downtrend started yesterday? And the simple answer to that is most likely NO.

Focusing on the big picture, we can say with confidence that one lower CPI inflation report won’t significantly alter the Fed’s plans to bring inflation down by tightening policy further. Nor should it alter the general uptrend in the dollar for now.

Nonetheless, markets will keep speculating and move around on various rumors because that’s what markets do. There could be more in store for this broad USD correction down, or it could be near its end. But, in any case, it’s worth keeping in mind that the DXY dollar index, as well as individual pairs like EURUSD, GBPUSD, and USDJPY, have already reached key technical zones. It will be no surprise if the dollar retracement ends here, just as many are getting excited about a big reversal.

Stocks’ rally to have a hard time extending

Another important factor that is likely to remain USD bullish long term but is this week contributing to its correction is risk sentiment. Looking at the most widely followed indicator of risk sentiment - the stock market - we can see a huge jump higher yesterday driven by the big CPI decline. Stocks are now extending the rally like there is no tomorrow.

But traders should beware. A growing sense lingers that the crypto rout may spread into other areas of the financial system, particularly stocks and trigger a bigger wave of broad selling. This threat should keep risk sentiment in check for as long as the Fed stays hawkish and keeps policy tight.

Yes, stocks are rallying after the CPI inflation miss, but that is likely only a reaction to a surprise economic report amid position adjustments. But with QT running in full force and the Fed still set to keep hiking rates, monetary policy will continue to get even tighter and remain tight for many months. In this regard, it’s very hard to imagine equity markets rallying while the Fed is still doing QT and hiking rates.

In line with this, this week’s moves are still unlikely to be a big reversal of the bull USD trend but rather just an extension of the correction. Thus it would still make sense to look for opportunities to go long USD, now with the added benefit of better levels.

As shown above, many USD pairs are already reaching key technical zones. Perhaps the time to add new long USD positions is not far.

We’ll follow up with an update on this in our next newsletters in the near future.

Trade signals from the past weeks

- September 9, 2022 - Short EURUSD from 1.0050, 1st target was already reached in late September at 0.98 for +250 pips; the 2nd part of position now closed at breakeven (+250 pips added to our total P/L now)

- October 14, 2022 - Short EURGBP from 0.87 closed at breakeven = 0 pips

- November 1, 2022 - Long USDCAD from 1.3585, stop triggered at 1.35 = -85 pips

- Long USDJPY - setup now canceled following the events this week, but can be revisited in the coming days/week (signal sent November 2)

TOTAL P/L in the past weeks: +165 pips

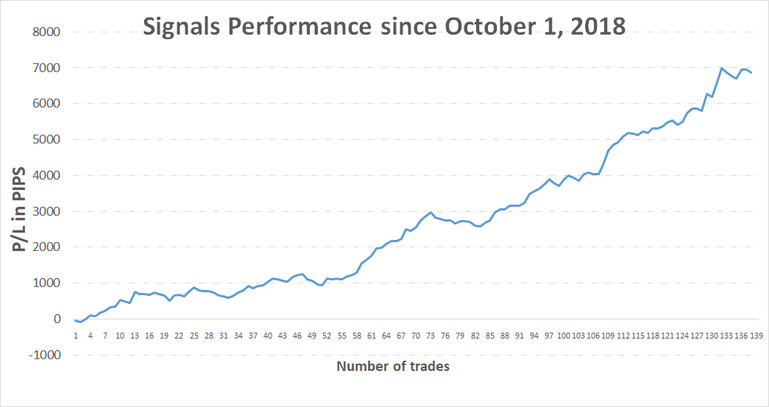

TOTAL: +6870 pips profit since October 1, 2018

SUBSCRIBE NOW to the Free Profitable Forex Newsletter

![Not a Dollar Reversal Yet [Newsletter Nov 11]](https://cdn.investworld.net/insecure/w:835/h:407/rt:fit/g:ce:0:0/el:1/f:jpg/c:0:0/q:90/czM6Ly9zZXJ2aWNlcy0tODM1OS0taW1hZ2VzL2JhNzJiN2EyNzJmNjk2MjhhMzhkMzllODU4NWU0MWEyYTFiNWYyZjAucG5n.jpg)