In the world of forex trading, experience and knowledge are the two main things that make a good trader. A newbie trader might be overflowing with ideas and knowledge on trading, but without enough hands-on experience, there is no telling if a trade will end up nice or not.

The trader’s experience tells what should be expected at the price of their financial asset with the help of various indicators. However, not all chart indicators can be considered simple to understand and handy as the Parabolic SAR. But before anything else, what does Parabolic SAR means and who is the brain behind this awesome tool?

Author of Parabolic SAR

Parabolic SAR was created by Welles Wilder who introduced the parabolic price / time system in his book back in the 1970s. To be precise, Wilder’s book in 1978 was entitled New Concepts in Technical Trading Systems. The acronym SAR means stop and reverse and SAR is the one that tracks price while the trend in the market is extending over time.

It is indeed important to look for a handy tool that would help traders get a good start in trading. However, it is also equally important to know how a trade will end up. Besides, what is the use of spending so much time on getting a good start if you will just end up a loser? This is where the Parabolic SAR or Stop and Reversal comes in.

How to use Parabolic SAR

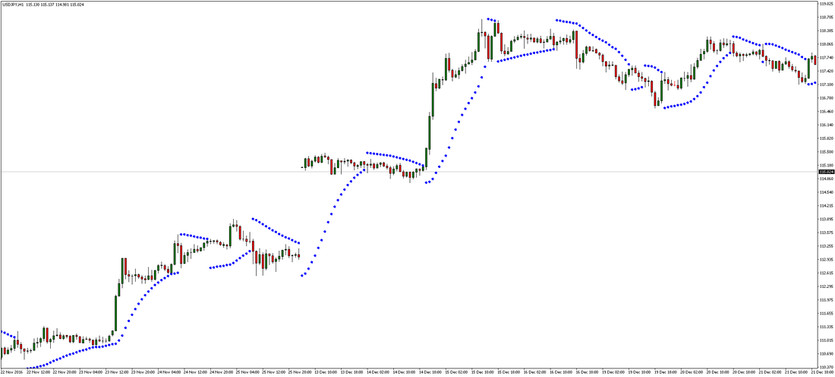

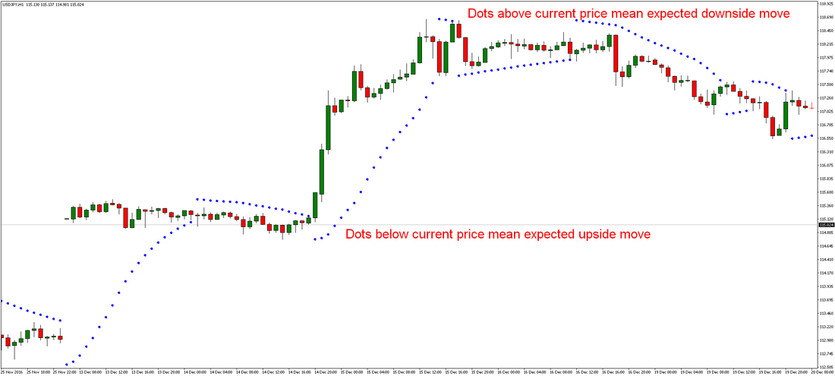

A Parabolic SAR indicator puts points or dots on the chart to point out the potential reversals in the price movement. As a matter of fact, this technical indicator is already used by many investors and traders to know the possible direction of an asset’s momentum. This tool also determines the time when the momentum has an above normal chance of changing its directions. With the Parabolic SAR indicator, you can nicely analyze current market trend.

Placing the dots is one of the essential things to remember when using the Parabolic SAR. Why? By simply placing the one or more dots at the wrong position, everything can be out of order once the chart is interpreted. Each dot is used by traders to create signals for every transaction that depends on where a dot is placed according to the price of the asset.

What makes the Parabolic SAR popular among forex traders is because of its simplicity. If the dots are placed below the price, it shows the signal for buying - upside trend. But if the dots are placed above the price, it shows the signal for selling - downside trend. As simple as that, even new traders won’t get lost in translating this chart indicator. Perhaps, this is also the easiest chart indicator to interpret since it simply shows if the price is going down or up.

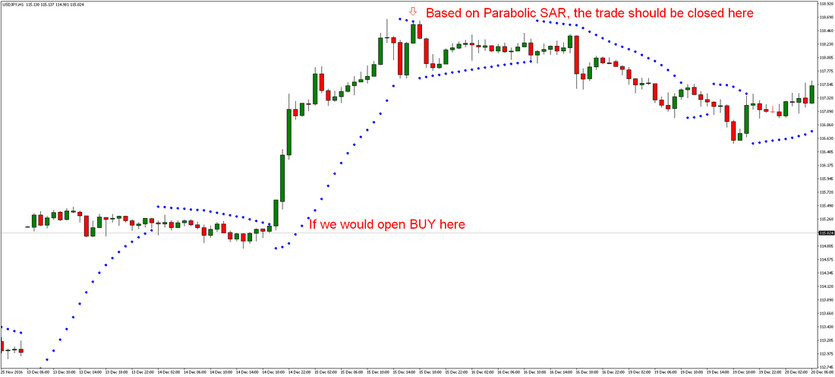

Parabolic SAR is also useful for deciding when to exit a trade or not. Once the dots started falling in the chart but managed to regain at least 3 dots back up, run to the exit! Trusting on three dots above is more than enough for you to win and avoid losing the trade for good.

Traders also often trail stop-loss based on the Parabolic SAR indicator. Simply move your stop-loss to the price level of each dot in the direction of your trade. Thanks to this, you will lock your profit and catch strong trends nicely!

In short, Parabolic SAR is the tool to use for your exit strategy or to confirm your trade decision. Parabolic SAR is specifically designed to follow the trend and tell you when to stop or stay.